American Butterfly

Angel Theory Part 3.2

Audacious Economics

The Theory of Every Business 2.01

A work in progress by Nick Ray Ball 5th January 2018

PRESENTING:

Chapter 2: American Butterfly

The original reason for classing S-World as economic was that it was a theory of money that was entered in to quite by chance in April 2011, to emerge as the economics vs theoretical physics ‘American Butterfly’ Books 1 to 4 in 2012-2013.

Inspired by Sienna Skye

In 2,445 Words

Version 6.94-r-k1

American Butterfly Economics

On January 1st, 2012 I started 4 months of economic and US construction research, and the notes alone (as seen on S-World.biz) are the length of 4 novels. And within came my much loved ‘Kobayashi Maru GDP Game,’ named after the ‘no win scenario’ made by Spock in Start Trek that was beaten by Captain Kirk when he reprogrammed the game.

The Kobayashi Maru GDP Game had 13 variables, from Medicare costs to the Interest on the Debt itself, which showed history back to 2009 and future projections for 2013, 2017, 2021, 2025, 2029 and 2033.

At the bottom of the graphic, the Kobayashi Maru GDP Game plotted…

- The GDP Debt Ratio (that the amount of all goods and services sold vs. the debt of the country).

- The Cost of Social Security, Medical Liberties, and the Interest on the Debt as a percentage of GDP.

(However, for simplicity (13 inputs not 89), I averaged as opposed to applying the actual curve. So, we only consider the 2009 & 2033 Social Security, Medical Liberties stats.)

Using the default figures, which were (mostly) accurate for 2011, and then continuing with those figures, the US GDP Debt Ratio started in 2009 at 82.6% and would rise to 169.2% by 2033. And the cost of Social Security, Medical Liberties, and the Interest on the Debt as a percentage of GDP increased from 11.7% in 2009 up to 34.3% in 2033, whereas the usual tax yield is only 18%. And that before we got there, the USA would have to impose massive amounts of austerity, which would in turn slow down GDP, and could spiral into bankruptcy and hyperinflation.

I considered, if there was a first move to solving the global economy, it would be to make sure the USA does not spiral into bankruptcy.

However, the worrying thing about the ‘Kobayashi Maru GDP Game’ was that as you changed the 13 different variables using figures within reason, the USA still reached untenable levels of debt vs commitments, slower maybe but still the same eventual result, too many commitments to pay for vs income and borrowing at a reasonable rate.

At the time, the only way that I could get it to work was by eliminating the Medicare and Medicaid costs, which of course was cheating. But if Captain Kirk can do it, so could I.

In theory, the S-World solution was to build 8,192 Grand Networks in the USA, and in each is a hospital so that no one was more than 20 miles from care, and branch out into pharmaceuticals and medical technology.

This in exchange for the US or state governments reclassifying the land we needed to build the Grand Networks in the first place from agricultural to industrial, commercial, and residential.

The vehicle behind how we would accomplish this became known as the first American Butterfly book ‘The Theory of Every Business,’ as all the businesses who constructed or later operated within the Grand Network would be part of the S-World network; and collectively, all would contribute to special projects http://americanbutterfly.org/pt1/the-theory-of-every-business/index.

And in this case, a set allocation of funds per year would need to go to Special Project 10. Global Healthcare.

Having worked out the objective, the project then changed to practicalities and how to build so many Grand Networks, and how each could afford to cover the medical costs.

With a population of 326 Million, we divided by 8,192 networks and get just under 40,000 people, which we may increase by 10,000 for population growth in 20 or so years, so 50,000 people. And that using a quick sum, the UK NHS costs $3,000 per person; then each resort development needs to pay $150 Million for that sort of service, or $75 Million if the objective was to cover half of the US liabilities, as existing health care can’t just stop and is already in all cities.

And note, as always, before going into actual business, we simulate it in S-World UCS, including very detailed scenarios for the NHS and other governments health systems.

And so, having worked out a solution, the next objective turned into the profitability of a Grand Network whilst factoring in the laws of diminishing returns created by having so many Grand Networks in the first place. And we are still working on that, albeit now the launch is more likely to be in Africa, as we found out from Angle POP, Grand Networks in locations of Special Projects are Special Projects.

One single Grand Network assists all 17 Special Projects.

http://www.angeltheory.org/book/1-4/Special-Projects

President Barack Obama

Fortunately, given that it’s taken 6 more years to create the inner working of the S-World network, President Barack Obama and his economic team had their own ideas about the same problem. For sure they probably had their own version of the ‘Kobayashi Maru GDP Game.’

In ‘Obama’s Game,’ he made 2 bold changes; lowering borrowing by half a trillion a year to an average of $900 Billion, and he lowered interest rates to 0.2%. And it’s amazing, the effect in just 2 years, changing the status quo from a predicted 105.4% GDP debt ratio to a 98.7%, where after it grew at 1.5% a year.

The result of this is that the USA in 2017 is looking at a GDP debt ratio of 105.7% in place of the forecast 122.7%, a great result given the starting conditions. Albeit the lowering of interest rates can cause other problems.

As for the cost of Social Security, Medical Liberties, and the Interest on the Debt as a percentage of GDP, I have not remade these figures as accurate medical figures are hard to find. And so, the 15.6% in 2017 is wrong and should not be considered other than the obvious:

With an aging population seeing people live 20 even 30 years longer, that’s going to increase the medical liabilities and social security payments a lot.

And in this case, the American Butterfly medical liabilities plan would still be a life saver, especially now that thanks to President Obama’s last term, the need is now less. And that if all went to plan, covering just half of the medical liabilities plus the extra payroll and income tax contributions from all S-World personnel and companies would be enough to put the USA on the right path, so long as politicians don’t find new ways to spend the money.

However, now 6 years down the road, if we listen to best economics by Thomas Piketty, we find that the best locations for grand networks is in emerging and very small economies.

Too Much Capital Kills the Return on Capital

By Thomas Piketty

From ‘Capital in the Twenty-First Century’ Chapter 6

Whatever the rules and institutions that structure the capital-labour split may be…

It is natural to expect that the marginal productivity of capital decreases as the stock of capital increases.

For example, if each agricultural worker already has thousands of hectares to farm, it is likely that the extra yield of an additional hectare of land will be limited.

Similarly, if a country has already built a huge number of new dwellings, so that every resident enjoys hundreds of square feet of living space, then the increase to well-being of one additional building—as measured by the additional rent an individual would be prepared to pay in order to live in that building—would no doubt be very small.

The same is true for machinery and equipment of any kind: marginal productivity decreases with quantity beyond a certain threshold.

(Although it is possible that some minimum number of tools are needed to begin production, saturation is eventually reached.)

Conversely, in a country where an enormous population must share a limited supply of land, scarce housing, and a small supply of tools, then the marginal product of an additional unit of capital will naturally be quite high.

The above classical economics by Thomas Piketty suggests that one is more likely to have success with a ‘Theory of Every Business’ BabyPOP Super Grand Network in a location where there is almost no housing, industry, and retail such as Malawi or Zimbabwe; but equally, I think Greece and India and most of Africa, South America, & Asia.

As for the USA; reducing, borrowing, and creating an annual surplus year after year will go a long way to avoid the problems highlighted in the documentary: ‘End of the Road, How Money Became Worthless.’

American Butterfly Book 2: Spiritually Inspired Software

http://americanbutterfly.org/pt2/spiritually-inspired-software/index-spiritually-inspired-software

American Butterfly Book 2 started with…

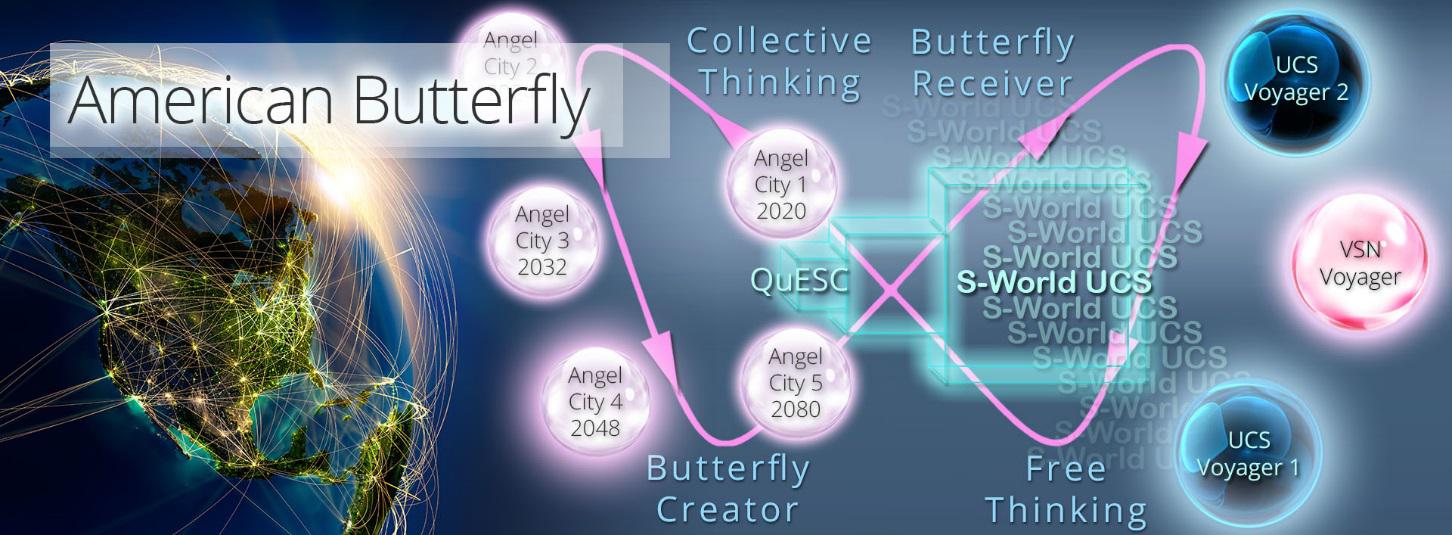

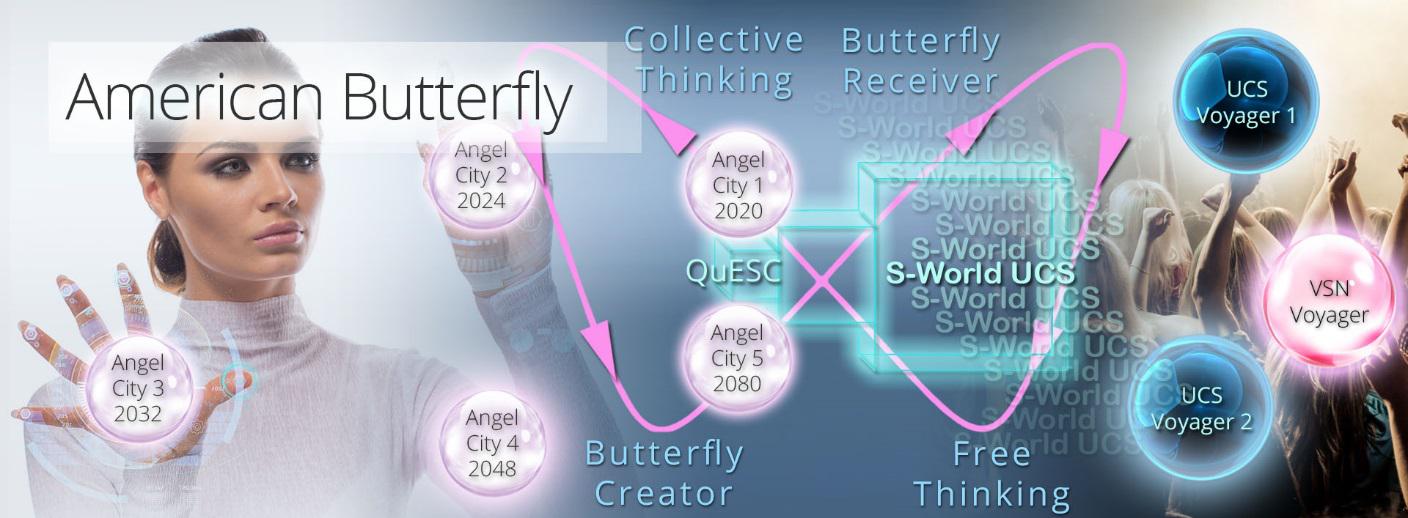

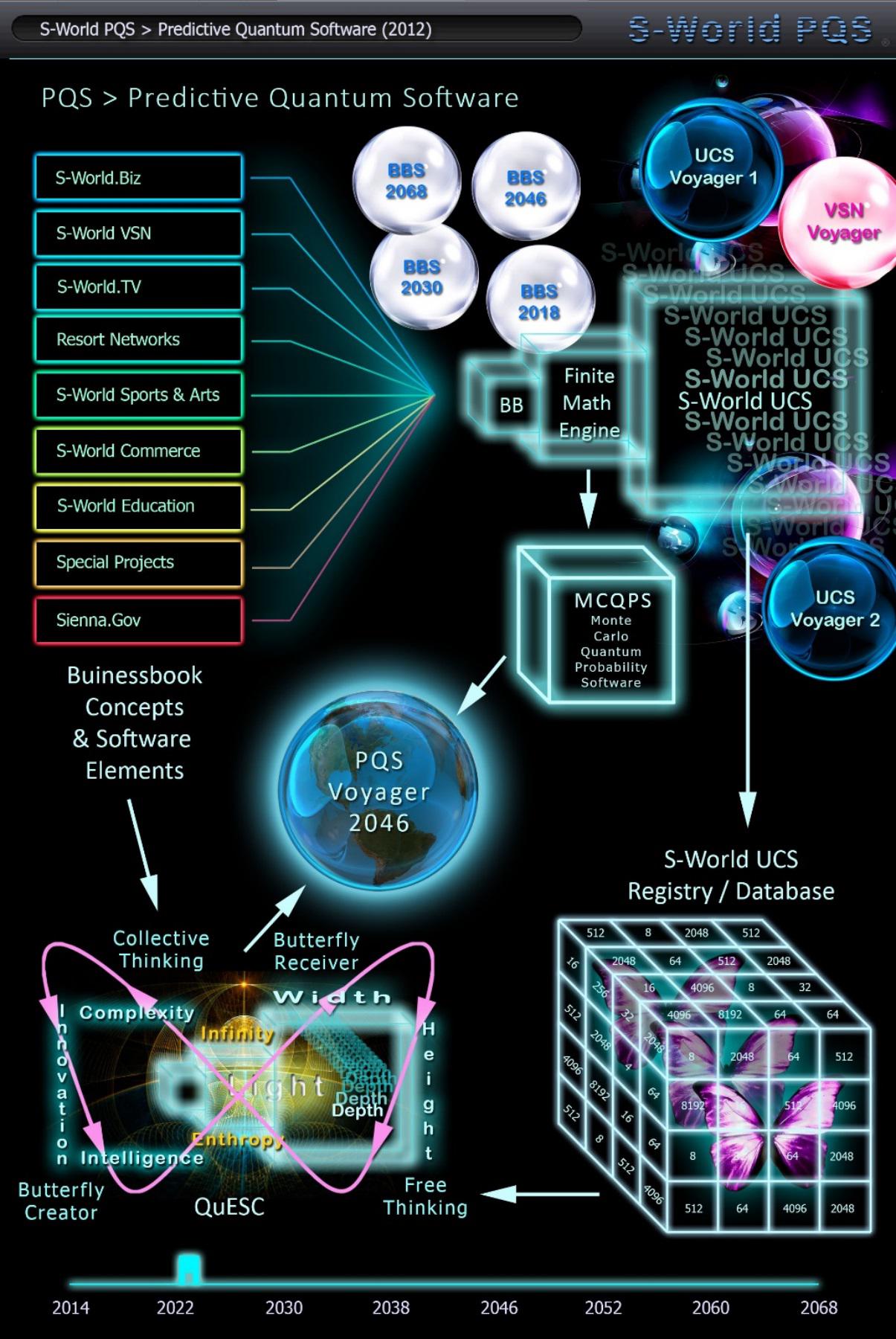

Chapter 1. ‘The Entangled Butterfly’ and seeks to introduce chaos theory and quantum physics to the reader. In this first chapter, it also presents M-System 11 QuESC, and the PQS ‘Predictive Quantum Software,’ the previous name for ‘M-Systems’ illustrated below.

Chapter 2: ‘To Infinity and back’ mostly looks at the POP Principle, which is now more concisely presented in Angel Theory Chapter 2. Part 2 ‘The Flap of a Butterfly’s wings.’ www.angeltheory.org/book/2-1/the-flap-of-a-butterflys-wings

Lastly, ..

Chapter 3 ‘Strings of Life’ is retold in Book 3 ‘The Network on a String.’

American Butterfly Book 3: The Network on a String

http://americanbutterfly.org/pt3/the-network-on-a-string/index-the-network-on-a-string

Book 3. ‘The Network on a String’ became a story about 16 Points of SUSY (supersymmetry) Similarity, albeit it would be more accurate to say M-theory similarity. At the time, I completed the first 8. The first 8 and last are now found in Angel Theory Chapter 2. The E-TOE www.angeltheory.org/book/2-1/m-theory-and-the-e-toe.

We shall focus on 2 key points:

From the Prequel Chapter: CFM and the POP (M⇔Bst) Investment Principle

http://americanbutterfly.org/pt3/the-network-on-a-string/prequal-cfm-and-pop

The (M⇔Bst) is for our purposes ‘BabyPOP,’ as is desribed in the 2017 update www.angeltheory.org/book/2-3/the-network-on-a-string.

But, before we arrive at BabyPOP, we need a little guidence on Classic POP.

The POP investment principle follows a pattern where companies (or networks of companies) trade, making as much as they like. But at a certain point of profitability, a line is drawn from which point onwards. The additional profit is invested into a new network.

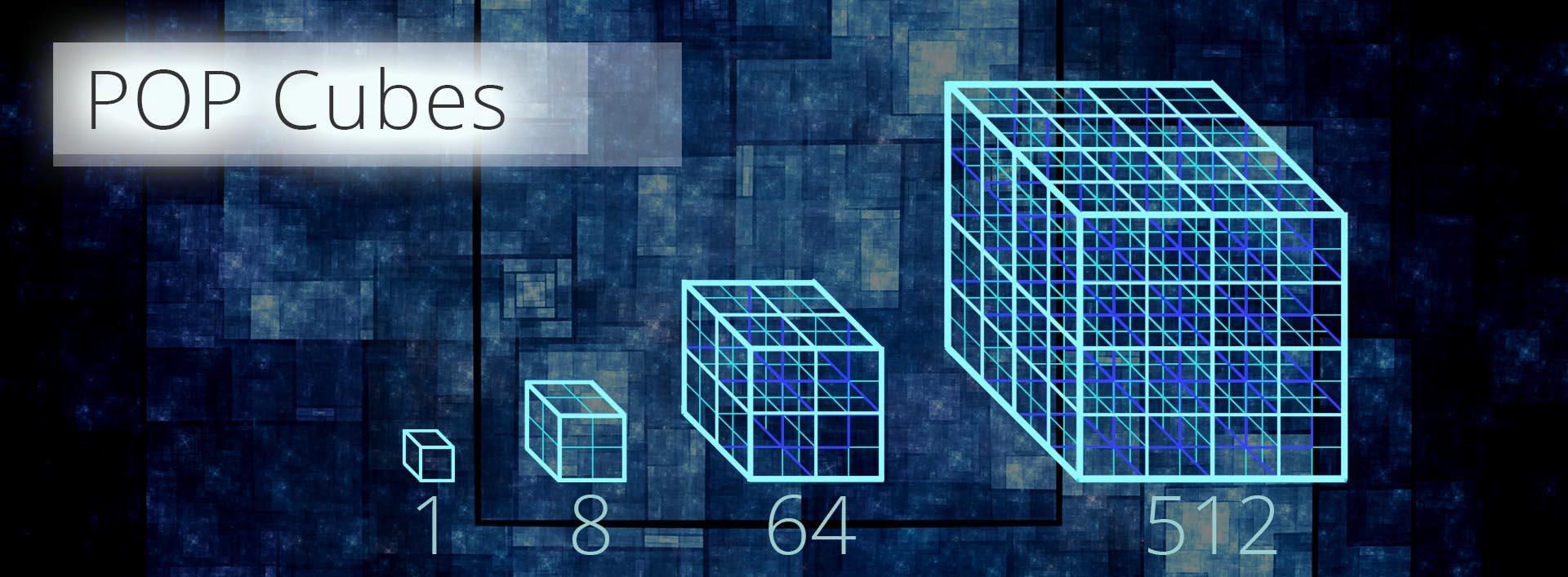

Once a cube is full and each company within has achieved its POP point, the cube would represent a single block of underlying profitability, and could be counted simply as 1. And other cubes created will be counted as 2, 3, 4, 5, 6, 7, 8 at which point we created a larger dimensional cube representing 8 networks of companies making their POP points. This follows to the next dimension of 64, and then next at 512 companies, all making their POP points and continues to increase in multiples of 8.

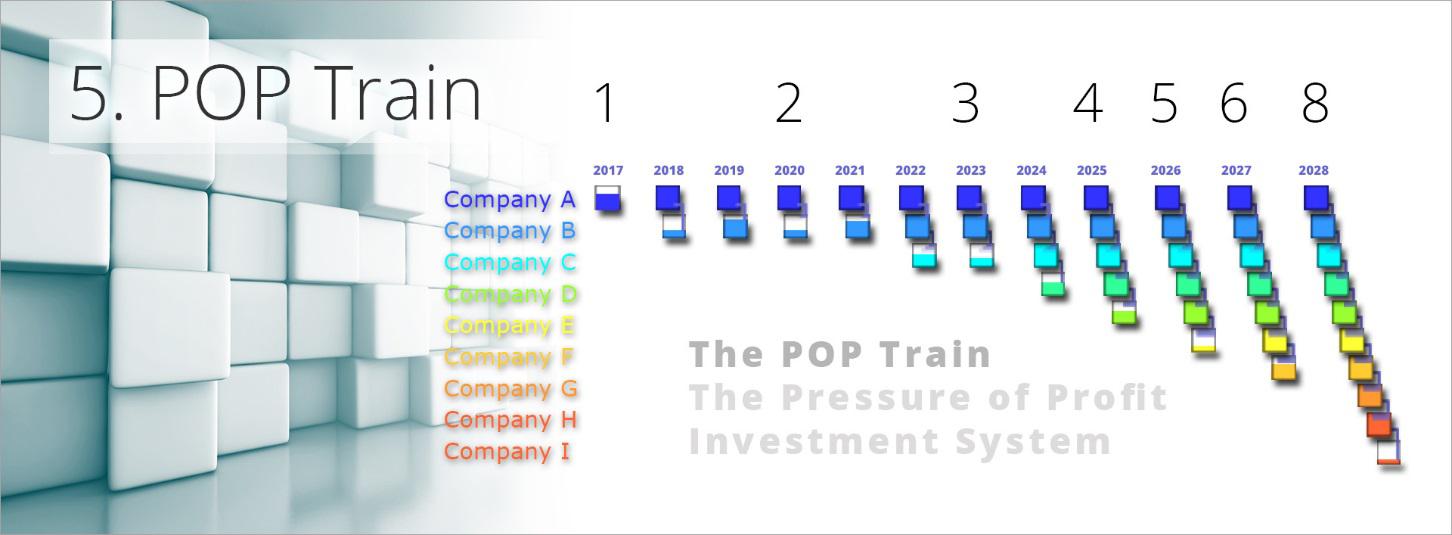

What turned a mathematical curiosity into the mathematics that underpinned the entire project was revealed when making the graphic you see above called the POP Train.

This point may have been subconsciously influenced by the South African Bulls rugby team and their train tactic; where three, then four, then five players line up behind the ball carrier and push in series, and the pressure of 5 teammates pushing in a line breaks through the opposing team’s defence.

When investing in a POP train, all the POP investment from the first network of companies flow into the second (and we call the object that the overflow falls into a ‘bucket’). Once bucket 2 is full, both networks 1 and 2 combine to fill ‘bucket 3.’ And once bucket 3 is full, networks 1, 2, & 3 combine to fill ‘bucket 4.’ After which new networks are created annually and the network snowballs and grows exponentially.

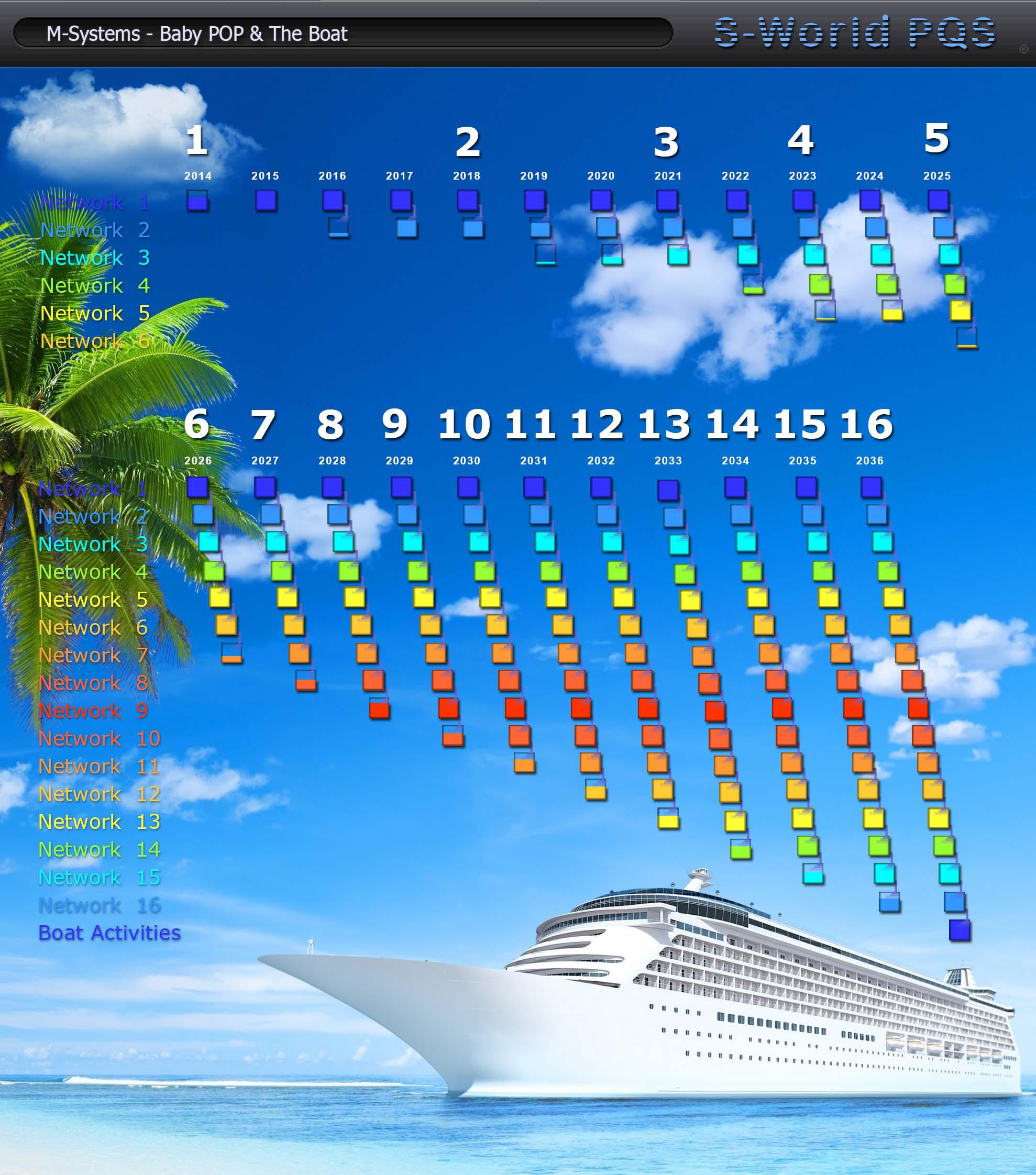

Below, we see this principle not for one company, but for a collection of thousands of companies working together, and these collections of companies become Grand Networks.

BabyPOP

Here is the original graphic, showing now 16 Grand Networks investing per the train method of POP which eventually creates ‘The Boat,’ full of investment profit, and set for new reinvestment or new adventures.

To recap, once the original Super Grand Network had reached its POP point, all additional profit pours into the creation of a new network. And later when this new network reaches its POP point, both the mother and baby networks combine to feed a third, and then a fourth until all 16 Grand Networks are making their POP investments in a train pouring their collective POP profit into what we called ‘The Boat,’ ready to sail away to fund the start a new Super Grand Network.

For the math behind this, see http://americanbutterfly.org/pt3/the-network-on-a-string/prequal-cfm-and-pop. It needs updating of course. However, what worked in 2012 with 1 year of research will for sure work better in 2018 with 7 years research and development, as will be seen within this chapter.

The Baby POP boat, as we just saw displayed as a giant cruise liner under the POP train, is the POP investment of a BabyPOP Network after all 16 Grand Networks have achieved their POP points. This is the Baby POP boat ready to reinvest into the original BabyPOP network, bringing all Grand Networks to Super Grand status.

But importantly, if the US and the West had originally invested in the developments and had since hyperinflated, we can see ‘The Boats’ of all the BabyPOP sailing to support its original founders/investors.

It takes quite some imagining that, in the future, Lake Malawi would be propping up S-World business in LA, or San Francisco. But if hyperinflation happens, economies such as Lake Malawi and other grand networks in locations of abject poverty may well be the ones that benefit most.

The BabyPOP Boats are philanthropic as they will take ‘Give Half Back’ POP investment to where it is needed most, be that continuing to grow at maximum pace in their parent country, or if the West has financially crashed and is in turmoil, Baby POP boats will sail to its aid.

But with this said, it would be far better if the West did not crash, as only in The Boat reinventing into the BabyPOP network do we have the opportunity to create quality housing, medical care, education, jobs, and much more for most of the population in countries such as Malawi or Zimbabwe.