Basis For The Agreement + M-Systems

Villa Secrets Network – Basis of the agreement

Basis of the agreement

By Nick Ray Ball 22nd August 2016

Index

Basis for a Licenced Agreement within the Vila Secrets Network

Before I begin a quick word on the theoretical math, as such math often provides the ‘why?’ it seems pertinent to include some basic details. A fuller description will soon be posted in the section ‘M-Systems’ at Network.VillaSecrets.com.

The math that influences the network is called m-theory, which is itself a collection of theories that all at one point or another connect. Professor Steven Hawking (as was recently portrayed in the Oscar winning film ‘The Theory of Everything) describes m theory as:

‘The only candidate for a complete theory of the universe.’

‘M-Theory is the unified theory Einstein was hoping to find.’

But why would we wish to emulate such a theory in business? Again from Professor Hawking, this time describing elegance as the first component of a good theoretical model:

Elegance is not something easily measured, but it is highly priced among scientists, because laws of nature are meant to economically compress a number of particular cases into one simple formula.

So by following the laws of nature ‘in theory’ we can create an economically compressed network.

Part1. The Network

In this chapter I present the network (a group of companies) that create the basis of this agreement and I outline the reasons why the licensee can make greater profit as a part of a group of companies, than it can as a single business.

Firstly, and in simple terms, a business owner or stakeholder and their 2IC (second in charge) are motivated both monetarily and emotionally (pride in successes, dismay at failures) in the business they own/manage.

In each Villa Secrets location, i.e. ‘Cape Town’ we will create a network of 8 companies, all in real estate related fields. (this process may take a few years to complete). Ideally each company will only have 3 key staff, with an additional Villa Secrets pool of staff (Who are themselves incentive in various ways) in hospitality, media and marketing roles who assist all the companies in the network.

Collectively creating a network of about:

a. 8 company owners

b. 8 2IC’s

c. 16 well monitored key staff

d. 8 Villa Secrets hospitality, media and marketing staff

If we compare this staff compliment to a typical SME (Small to Medium Enterprise) with the same amount of personal…

e. 2 Company owners

f. 2 2IC’s

g. 6 middle managers

h. 30 staff

Well… the numbers speak for themselves.

I did not recently decide this; it has been the foundation of the business network since February 2011 when I created the first ‘S-World’ networking software design. This was followed by 42 chapters of development culminating in the macroeconomic theory/book ‘The Theory of Every Business’ in April 2012.

This was in turn followed by a yearlong journey into theoretical mathematics applied to the network design on a grand scale. Followed by three years of development of the Villa Secrets web framework and the microeconomic network structure.

(The work so far is currently being put on line, and will be available soon.)

One of the important lessons learned from working out the macro plan in theory, was the rather obvious point that each company in a network needed their own unique way to generate income. And this point has over the last three years been reverse-engineered into microeconomics and the 8 companies we wish to join the Cape Town network.

I have been asked Why 8?

In part, it has to do with creating a system that is lesser effected by rounding errors, as will soon be presented as point 5 of M-Systems ‘POP – Financial Gravity.’

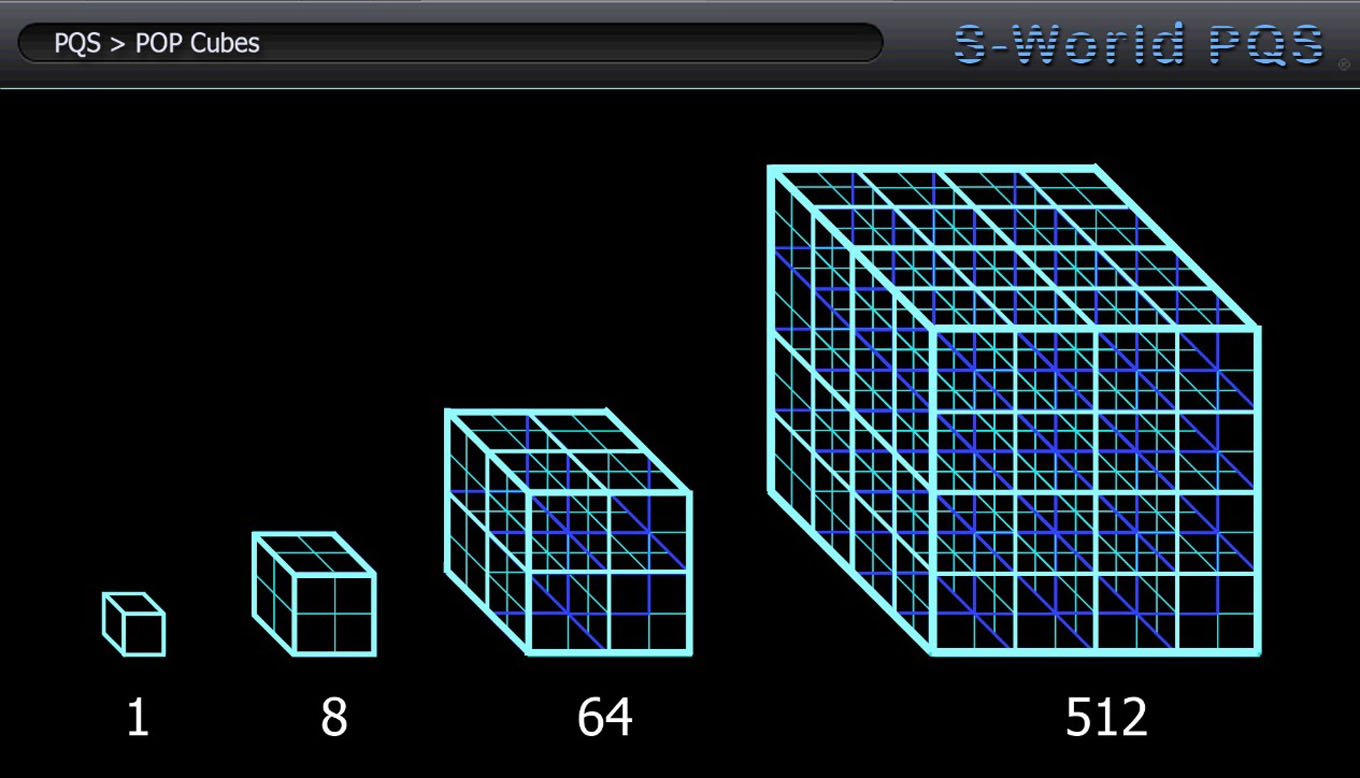

However, to quickly summarise, please look at the following graphics, and follow the journey of one small micro network (as we are currently creating) on its journey into a global macro network. And appreciate that if the macroeconomic (big) version was drawn around the world with each cube over its corresponding company, it would look similar to how theoretical physics such a Professor Brian Greene draw Sir Isaac Newton’s theory of gravity. See THE FABRIC OF THE COSMOS: What is Space? (At 6.50 minutes)

One can interpret the above as 8 companies in a micro network, then 8 micro networks across one or a few countries and 8 such networks spread across Africa, creating a continental network. So eventually creating 512 companies in Africa

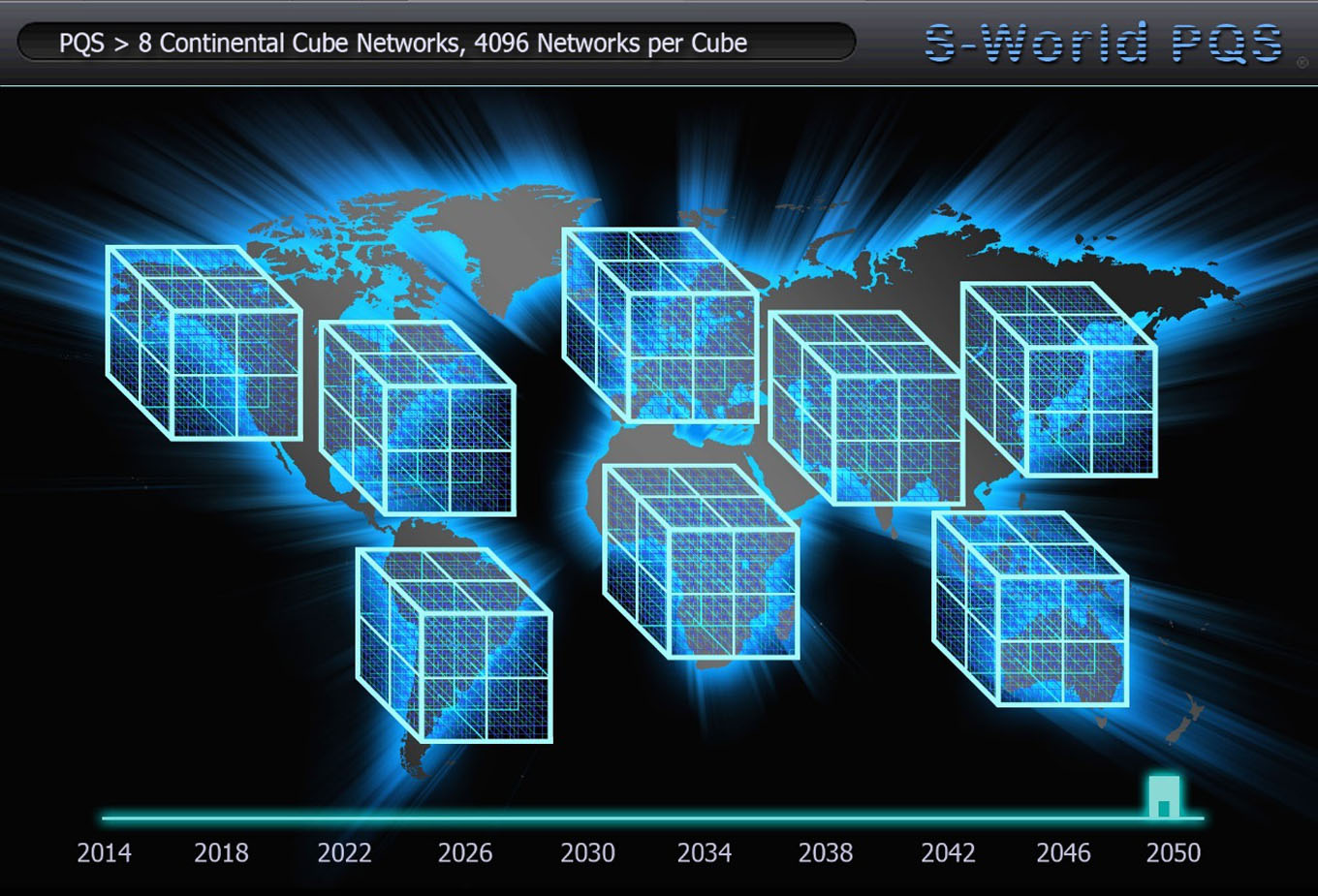

And below we see the global picture, where for each real estate network 7 different industry networks are also created.

In the above we were looking ‘in theory’ at a creating a global network that dominates the travel and real estate industry, which at this juncture to many may seem over ambitions. However, if one was to make such a plan, building it on the pretext that for every five staff there was a business owner, a 2IC and 2 key staff, should the network reach its lofty goal, it would be stronger than its competitors simply due to it makeup of personal.

…

Getting back to the network at hand, ‘Cape Town Real Estate’ which will be known as ‘the founding network’ and due to the POP (Pressure of Profit investment system) (part 3 of this agreement) the owners of the Cape Town network can eventually become shareholders in many of the other global networks.

Within the Cape Town network there will be some internal competition between the companies, which is healthy, but as each company’s main income source (or marketing method) is safeguarded, each company will either do well from their own exclusive marketing options, or very well from their own exclusive marketing option plus doing well in other areas.

For instance, if the founding network company ‘Cape Town Luxury Villas’ (from now on known as ‘CTLV’) were to sell villas, or book multi leg safari + villa holidays, or any activity that is not currently included in their financial forecast.

let’s now look as some of the specifics.

a. CTLV Almost Exclusive Marketer for Google AdWords Europe

Note that this does not exclude ‘CTLV’ from advertising outside of Europe, its simply that only ‘CTLV’ and one other company can advertise in Europe, in a top position (which we enforce by creating a max $4.50 bid price on any keyword)

For ‘CTLV’ in the sub-network class ‘Villa Rentals’ most of its initial revenue is created by Google Ads, our tried and tested formula for 14 years.

CTLV has rights to advertise 2 websites on Google Ads in Europe, and receives 50% of the enquiries from CapeTown.VillaSecrets.com which is also to be advertised on Google. Only one other company will be allowed to advertise one other website on Google in Europe for keywords related to villas in Cape Town.

This advertising method is tried and tested, creating more than 65% of the enquiries for the prototype www.Cape-Town-Luxury-Villas.com. (the balance of enquiries coming from organic (free) Google searches & previous clients re booking).

The 2015 figures and the 2016 management accounts for this company are the financial basis for all projections. But note whilst the company made ZAR1,410,000 ($105,000) in gross profit, for the sake of caution the projections are based on ZAR1,000,000 ($74,000).

In the case of CTLV, they will also receive enquiries from CapeTown.VillaSecrets.com and in time VillasInCampsBay.com. Both advertised in Google Europe (and other locations). Google AdWords been the stable diet of my other company CapeVillas.com since 2002, note that this competition is already included within the 2015 results. (as Cape Villas.com was already competing with CTLV in 2015)

We can’t say for sure until we test Villa Secrets on AdWords in October 2016, but common sense tells us that as Villa Secrets is a vastly better website, both visually and technically, it should outperform CTLV. And if so VillasInCampsBay.com will follow suit as it will be very similar.

It’s important to note that internationally, Cape Town is the most expensive location to advertise villas in the world. Thus if one can succeed using our Google Ads system in Cape Town it follows that one can succeed in many other locations.)

In addition to the three websites, ‘CTLV’ is licensed to mandate 8 Villas, which creates a fourth profit centre. Where after all profit centres are increased by the TFBMS (Total, Financial, Business & Marketing System) and M-Systems.

The more companies in the network, the more money there is for the development of the TFBMS and M-Systems. And so the faster and more effectively they will be created. In addition, the more money there is for Global Branding, such as Villa Secrets Magazines and international adverting campaigns.

Note the development of the TFBMS and M-Systems changes a good plan, into an exceptional one. And with the personal as presented, the Villa Secrets Cape Town network is set (in theory) to become the main force in luxury villas sales and rentals.

Note, Google AdWords Europe is not completely exclusive, CTLV can advertise 2 websites and receives 50% of the enquiries from CapeTown.VillasSecrets.com. One other company in the network will also have rights to advertise one website, but not it the number 1 position (unless by accident)

Additional Note, CapeVillas.com is already adverting in top Google Europe positions and is free to continue.

Note in general, with over 100 different keywords, different adds appear in different positions, and not every website will be the top 4 for every keyword, hence there is room for 5 or 6 different websites to do well from Google Ads. The 6th being Airbnb.

b. Creating a collection of villas exclusive to the licensee and the network

Note that when we say ‘exclusive mandate’ we are talking about the marketing and booking rights to a property, that is exclusive to the companies in the network and their affiliates. Typically, the company that signed the deal for the mandate will receive 10% from each booking, and the company that rented the villa would receive 15%. If a company rents out a villa that they signed, they receive 20%.

Trying to get an exclusive mandate is easier for a network of companies that a single company.

In our experience, which includes the founding and running of www.CapeVillas.com from 2002 to 2010, we are aware that whilst AdWords has been essential, access to exclusive properties, that can’t be accessed by competitors at the same rate, can increase profits and prestige sustainably.

When one presents villas to clients that are readily available to other agents, or worse readily available direct to the public via HomeAway, Airbnb, Booking.com or other such owner direct booking channels, one cuts the chances of making the booking in half, maybe in a quarter. In terms of affiliate marketing (working with other agencies,) the effect is greater.

This is not to say that working without a collection of exclusive villas is not profitable, as www.cape-town-luxury-villas.com (CTLV) has no such mandates and is profitable. The point is, if ‘CTLV’ had access to a collection of 25 or even 50 villas, that were exclusive, or that gave a higher discount, then bookings to clients would double, repeat booking would quadrupole and bookings from agents would increase by a factor of up to 8.

As such, there is an express need to gain exclusive villas, I have a significant presentation for villa owners, including over 30 different reasons for an owner to give ‘CTLV’ a mandate. We will also advertise in Google for positions 1, 2, 3 & 4 for property management keywords. As such for CTLV the acquisition of 8 exclusive mandates in 18 months is a realistic target.

However, I have found that in many cases, that the right team for closing bookings, which is the primary purpose of the licensee within the CTLV franchise, is not necessarily the right team for acquiring mandates. And even if this is not the case, the target of eight villas over 18 months is not sufficient.

Hence I intend to creates a wider network of 8 companies, as collectively these companies could recruit the 25 and then 50 exclusive properties. And when we do as ‘CTLV’ is the primary the booking agent in the network, it more than any other company will reap the rewards from this bounty.

Below we the type of companies currently considered for the Cape Town network. (On the right we see the principle source of income.)

a.i. CTLV a Villa Rental Company Bookings (Cape Town)

a.ii. Villa Secrets Africa Bookings (Africa)

a.iii. A Local Real Estate Agent Mandates & Sales (Africa)

a.iv. An International Real Estate Agent, Mandates & Sales (Global)

a.v. An Apartment Rental Specialist Bookings & Mandates (CT)

a.vi. An International Villa Company Bookings & Mandates (Global)

a.vii. Architectural Company or Developer Mandates (Global)

a.viii. Villas Cloud or Other Mandates & Booking Systems

All companies will attempt to gain mandates. Companies iii, iv, vi & viii will specialise in gaining mandates, so given we create the network as seen above, collectively, the network will in one way or another gain a significant amount of mandates, target 25 five-star (or above) villas or apartments by the middle of 2018 and 50 by the end of 2019. (or preferably sooner)

c. Mandates

My experience tells us that different owners or property managers have different preferences about the actual agreement and so to accommodate villa owners wishes, there will be different mandates, however the standard mandate will be exclusive to the network and be for 25%, where the company that recruited the mandate received 10% and the company that made the booking receives 15%. In many cases, the Villa Secrets will create price comparison sites, (we have recently purchased the domain VillasCompare.com) and place the villa in the public domain at a higher price, so the clients will not ask for a discount as it seems they already have one.

The critical factor in the above, for the licensee is that for each enquiry they receive, they can with confidence send clients villas, knowing that the client cannot book the villa elsewhere, which experience has shown will increase likelihood of closing a booking by more than 100%, more so, if one includes affiliate agencies I would expect a conversion rate of 1 in 2 as opposed to 1 in 5

It will be the case that at times a client will enquire with more than one network member. In such cases either both companies can deal with the client, but the second company cannot offer the same exclusive villas that the first has.

Via the booking system/CRM (consumer relationship management) (Not complete yet, but a simple system can be made), the second company can see what the first company will have presented, and those villa will be reserved for the first company. If the client asks specifically about a reserved villa, they are required to tell the client the villa has been reserved by the other company, specifically naming the other company in the correspondence.

c. Other companies in the network who primary rent accommodation

c.i. CTLV a Villa Rental Company Bookings (Cape Town)

c.ii. Villa Secrets Africa Bookings (Africa)

c.iii. A Local Real Estate Agent Mandates & Sales (Africa)

c.iv. An International Real Estate Agent, Mandates & Sales (Global)

c.v. An Apartment Rental Specialist Bookings & Mandates (CT)

c.vi. An International Villa Company Bookings & Mandates (Global)

c.vii. Architectural Company or Developer Mandates (Global)

c.viii. Villas Cloud or Other Mandates & Booking Systems

Above we see that in addition to ‘CTLV’ companies ii, v, iv list accommodation bookings as their primary income. However, in each case, the company is primarily using a different adverting medium and is competing in a different market.

For instance:

Company ‘ii,’ Villa Secrets Africa

Villa Secrets Africa is currently in the running as the company to deal with the other 50% of CapeTown.VillaSecrets.com enquiries. However, that’s the end of the story for Villa Secrets Africa and Cape Town. Villa Secrets Africa will focus on the pan African picture, a good way to picture this is simply to look at the Villa Secrets homepage or the blog page. http://blog.villasecrets.com

Villa Secrets Africa will be born from an existing travel company experienced at booking flights and multi leg holidays.

Currently one of the contract conditions for this company is a large Google AdWords budget for advertising at position 1 on generic keywords like ‘Luxury Villas’ & ‘Luxury Homes’ alongside regional advertising in locations in Africa that do not have a network (which is currently everywhere except Cape Town)

Villa Secrets Africa will not have a dedicated Cape Town website, rather country specific and pan African websites.

Company ‘v,’ An Apartment Rental Specialist:

This company will focus on luxury apartments, primarily in the V&A Waterfront and Cape Town City. Currently such bookings are less than 10% of ‘CTLV’s income. ‘CTLV’ does not advertise the word ‘apartments’ or the location ‘Waterfront or City.’

However, as a part of the process of technically setting up the company for apartments, we need to connect to the Nightsbridge booking system. And as a result ‘CTLV’ will have access to over 100 quality apartments at an STO (discount) of 20% to 35%, which have shorter New Year minimum booking times, which can service the +/- 20% of all enquiries that are for less than 12 nights over New Year. As a result, ’CTLV’ will convert more bookings and increase gross profit, by the inclusion of company ‘v.’

Unlike the apartments company, ‘v’ who will be prohibited from placing bids over $4.50 on Google AdWords in Europe, ‘CTLV’ will be allowed to advertise for apartments in the Waterfront should they wish. (but not at the No1 spot if company ‘v’ is adverting on that keyword (again, unless it’s by accident)

As a result, the addition of company ‘v‘ will increase the gross profit achieved by ‘CTLV.’

Company ‘vi’ An International Villa Company.

Company ‘vi’ will also be precluded from adverting over $4.50 in Europe, for their Villa Secrets created website. And as a result their inclusion into the network will not adversely affect the figures predicted in the ‘CTLV’ financial forecast.

There are a number of companies who could fit in this space, the prerequisite is that they are big companies, that deal with the most expensive villas, in the most expensive locations, who have a large database of clients, who up till now have only been able to access a small nonexclusive selection of Cape Town villas, or who have no presence in Cape Town at all.

All such companies will create income primarily from offering villas to their existing clientele, such companies will have many clients who are not shy of spending over ZAR100,000 ($7,500) a night, who may be interested in trying Cape Town, in particular as part of an experience that includes a safari.

In terms of competition, there may be cases where both company ‘iv’ and ‘CTLV’ have the same enquiry, but this will be rare.

What company ‘iv’ brings to the table is a global brand name, which will further impress owners into giving their properties exclusively to the network.

In addition, it brings ‘big spender fire power.’

It is one thing to gain an exclusive mandate, it is another to fill it with bookings, especially at the higher end. We hope company ‘iv’ will create a significant amount of the bookings for the most expensive properties, including times that are not peak. So keeping the mandate and having results that can be presented to other villa owners.

d. 31 Advantages to the licensee created as a result of the other 7 companies in the network.

I have created a report that identifies 31 different advantages to ‘CTLV’ created from the other 7 companies in the network. However, as this report identifies the specific companies I am targeting and it is a rather long document, I shall not present it within this point, rather it will be presented as a separate document available on request.

However, the I can present the way it displays these advantages within M-Systems (available on line soon)

A53⇔B57⇔C60⇔D42⇔E44⇔F62⇔G61⇔H63

DON’T PANIC!!!

The above is very simple, each number reflects the amount of advantages an individual company has gained from the rest of the companies in the network.

In the case of ‘CTLV’, which is company ‘A53’ it has 53 advantages. Why the increase from 31? This is due to some advantages being more powerful and as such they score more than one point.

So far I have discussed one of the advantages that creates the 31 points, this being that the mandate recruiting companies will add quality exclusive properties which are available to the licensee to rent in an exclusive manor that does not allow another company to present a better deal.

Another advantage is that all companies will pay for a communal sales person/live chat operator, so communally creating 24/7 live chat and telephone answering. In essence having 8 sales staff manning the enquiries at all hours on each and every day.

In addition, as a part of the design for staffing the network, we desire some or most the live chat operators to be trained copywriters or journalists. And as such we will have a lot of quality fresh content on the villas and the location in general. This will be a distinct advantage for SEM (Search Engine Marketing) improving the Google Organic search position for all websites. And gaining direct clients from content marketing.

Another huge advantage is that each company will continue to contribute to the creation of the software and marketing platforms and as such with 8 different companies contributing, we shall create the TFMBS software and M-Systems far quicker than is currently forecast. (The current forecasts are for only one company contributing.)

lastly on this point, we take a peek at the mathematical inspiration… and note that within M-Systems we call networks ‘strings.’

An Extract from M-Systems.

System 2. The M&B String (M<>Bst) (A<>Bst)

String Theory / Business / Networking / The Butterfly Effect

We start the S-World network as a set of 8 companies, and apply to those companies ‘string like’ behaviour. We look for the advantages (ways to increase profit) one company has on another, and another, and another… At this point, if the companies we want to join the string, do, there are hundreds of advantages and only a few disadvantages.

We write these advantages like so: A53⇔B57⇔C60⇔D42⇔E44⇔F62⇔G61⇔H63

the number representing the amount of advantages created from the rest of the companies in the string. Note the symbol ⇔ is the symbol for iteration, the creation of feedback loops, circular events & ‘economic butterfly effects.’

e. What happens if one or more of the 7 other companies in consideration does not wish to join the network

e.i. CTLV a Villa Rental Company Bookings (Cape Town)

e.ii. Villa Secrets Africa Bookings (Africa)

e.iii. A Local Real Estate Agent Mandates & Sales (Africa)

e.iv. An International Real Estate Agent, Mandates & Sales (Global)

e.v. An Apartment Rental Specialist Bookings & Mandates (CT)

e.vi. An International Villa Company Bookings & Mandates (Global)

e.vii. Architectural Company or Developer Mandates (Global)

e.viii. Villas Cloud or Other Mandates & Booking Systems

In all cases except ‘vii’ An Architectural Company, there are more than 2 alternates.

In the case of ‘vii’ An Architectural Company, I will seek an alternate company with the same role and income stream. As ‘vii’ is primarily a mandate recruiter, I would look at alternates that could fulfil the same role. For this reason, we see ‘or Developer’ added. As a developer who was building a large block of apartments could bring a bounty of mandates from the owners of the apartments.

Alternatively, or a ‘film and photoshoot rental agency,’ that has a large portfolio of villas not in the public domain, is also useful.

Below is the current full list of alternates in all categories.

e.ix. A Property Development Company

e.x. A Film and Stills Location Rentals Agency

e.xi. A Social Network

e.xii. CapeVillas.com

e.xiii. A Safaris Specialist

e.xiv. A Networking CEO

e.xv. International Concierge Company

e.xvi. A Commercial Real Estate and Letting company

e.xvii. An Iconic Luxury Brand

e.xviii. A Film, PR and Media company

e.xix. A Luxury Resort

e.xx. A South African Tour Operator

e.xxi. An International Tour Operator

e.xxii. A Local Events Company

e.xxiii. A Local Film Production Company

f. Phase 2, the possibly that the network will expand to 16 companies.

NOTE, this point is now relatively mute, instead it is planed that the current network will remain at 8 companies and be considered the Real Estate Network, and a second network will be created for travel, focusing of Hotels, Guest Houses, Flights, Safaris, Car Hire and other travel services.

g. Network Sub Companies (Internal Strings)

Opportunities will arise, where a network company can recruit a smaller company or individual as a ‘Network Sub Company.’

For Instance, a small villa rental company or individual who specializes in The Cape Peninsular, The Winelands, False Bay or Constantia.

Or in general any company or individual that will increase the profit of CTLV, albeit in each case I will need to approve the option.

The financial arrangement for such an partnership is currently under review and will be considered on a case by case basis.

A typical arrangement would be for the company to pay 12.5% of gross profit to CTLV

Another potential Sub Company would come from the franchisee making a ‘key man’ deal, in which after some time the ‘key man’ receives their own website, again paying 12.5% of gross profit to CTLV

Another potential Sub Company, would be for ‘CTLV’ to buy an existing company.

Villa Secrets Network

Basis of the agreement pt. 2

By Nick Ray Ball 22nd August 2016

Part 2. The ongoing Financial Contribution.

Like the previous points, the way we spend the ongoing financial contribution has its roots in theoretical mathematics. M-Systems Part 3 ‘The Susskind Boost,’ and M-Systems Part 4 ‘The Peet Tent’ are specific to this point. For now, we shall start with a look at a quote from the farther of string theory Leonard Susskind. ‘Lecture 1 – String Theory and M-Theory’ (at 34 Mins.)

Here is the paraphrased quote:

‘We boost the hell out of the system, until every single part has a huge momentum.

If there is any part that is going backwards, you just have not boosted it enough.

Just boost it more until its going forward with a large momentum.’

This is the inspiration for the ongoing financial marketing contribution.

To most the S-World Villa Secrets model looks like a franchise, with a set-up fee and a +/- 4% franchise fee. However, this is not the case, most franchises have a franchisee free (usually between 4% and 7%) and many have a separate joint marketing fee (Usually about 3 %to 4%)

S-World Villa Secrets has no franchisee free, rather a joint operations, development and marketing contribution.

This contribution is 25% of gross profit, which is equivalent to a +/- 4.5% franchisee fee

But as we said there is no franchisee fee, just the joint operations, development and marketing contribution. In which operations are designed to require just a small portion of the kitty (particularly as the network grows, the larger the network the less a percentage of the contribution goes to operations.)

The bulk of the contributions are assigned to boosting the profit made by each company. I have named this effect ‘The Susskind Boost.’

The Susskind Boost has different shapes, for different scenarios.

Here are some of its different shapes

I. Initial company boost.

(Note Professor Susskind makes a note that the smaller a string (network) is the harder it is to boost, so we always boost new companies as much as possible)

Initially all the money a company contributes is used to boost the company that contributed it, in a way that is specified before the start of operations.

This lasts for either 18 months, or earlier if a gross profit target is met.

II. Full String/Network Boost

All 8 (or as many as have been founded) companies in a network contribute to the boost, and the system decides the best way to boost the network as a whole. (Note that this does not mean a company that contributes receives no individual boosting, in the 3 year financial forecast for ‘CTLV,’ ‘CTLV’ receives much the same boost as it does in the initial boost, however the additional contributions are used for operations, software development and collective marketing (such as The Villa Secrets Magazine.)

Note that the two weakest companies in the network continue to use their own contributions to boost their own companies.

This is important, the companies that are doing well are boosted simply by the assigned direct marketing, development of the TFMBS and M-Systems, so in theory they will just get stronger and stronger as the software and systems improve/are created. By paying extra attention to the weakest, we are always strengthening the weakest points. S-World economics often looks at strengthening the weakest points.

III. Weak Company

If a company in a network starts making a loss, even after it has used its own contributions to boost itself, then money from the collective contribution made from the other companies in the network is used to apply additional boosting.

‘If there is any part that is going backwards, you just have not boosted it enough.

Just boost it more until its going forward with a large momentum.’

IV. Broken Company

This scenario is rather hard to imagine given the safeguards we will have in place, such as monitoring every cent of every company, the TFBMS, M Systems and having a termination of contract rule for companies that get themselves into untenable legal trouble (the client gets eaten by lion scenario)

However, should a company find itself in dire states a larger portion of the money generated by the rest of the network, can be diverted to assisting the flagging company.

Given the safeguards and if only one company in the string was failing, the 25% of gross profit from the seven successful companies is far more than the broken company would require.

Another scenario is that three or four of the companies in a network may all fall out of profitability. In which case depending on the performance of the winning companies the system has enough fuel to boost the flagging companies back to health.

But seeing as it’s a hard task for one company to fail, given the systems and safeguards, barring an ELE (Extinction Level Event) the probability of half the companies failing at the same time is very low.

To add some back up the above statement, consider that in general in travel it is less than 1 in 100 companies that fail, this stat being a reflection of the 1% it costs to get financial failure insurance in the UK. And in terms of South Africa and members of SATSA the cost is less that’s 1000’th of a company’s income.

It’s important to have a system in place that safeguards all/most companies, as its reassuring all round, and will build a sense of comradery. In addition, for people who wish to join the network but can’t afford the set up fee’s it will make raising finance easier.

In addition, it also ticks another ‘M Theory’ box. We call this effect ‘The Peet Tent.’ (M-System 4) See Dr Amanda Peet: String Theory Legos for Black Holes. (From 35.50).

The basics of the principle is that the predictable smooth results from gravity (heavy things like planets) can be unified with the jittery unpredictable quantum world, (very small things like atoms) by creating a tent that both sets of results can fit under.

In this case, we are not in any way using the mathematics of string theory in our solution, rather we have tried to simulate the effect.

One significant advantage is the bigger the network gets the largest that tent is.

V. Broken String/Network

Ok, so what if a ELE does occur, what then?

Well, let’s say it was a localised ELE that would have the same devastating effect but only on the local population. Let’s say a Tsunami took out Cape Town.

And lets forward the clock to 2020, at which time we would be very disappointed not to have networks in LA, Hawaii, St Bart’s, Bali & St Tropez.

In this case, the contributions to the Susskind Boost would be used from the international networks to bail out Cape Town

The other networks across the world could collective afford for the owner of each company and their 3 key staff to carry on surviving, locally or abroad.

The latter point ‘locally or abroad’ is explored further in the next section.

Villa Secrets Network

Basis of the agreement pt.3

By Nick Ray Ball 22nd August 2016

POP 1 ‘The Pressure of Profit Investment System’

Important note, for the first company or the first few companies in the Cape Town network the following is an opt in option that they can take up at any time (it is not enforced). However, it would be preferable if companies opt in from the kick off.

POP it is the founding mathematics of the network, but we need not get into that here, rather I shall just describe its effect.

If the systems perform to their potential, in about three years’ time the owner of ‘CTLV’ will be making about the same in shareholder discretionary income as was initially paid in set up fees. Currently ZAR3,200,000 ($235,000). A great investment in anyone book.

The POP point, is a pre agreed point of profitability, (often similar to the initial contribution ZAR3,200,000) where after, shareholder profit in excess of this POP point is invested into new ventures.

Currently there are two different POP investment options. Firstly, is investment into creating a new villa companies in a new network in a new location. Secondly is investment into a property development. (but for now we can only work with certainly on point 1.)

The model is that POP investment will pay for 50% of the initial contribution of a new company, for instance BaliLuxury.Villas, the balance being provided by the new owners/CEO of the company.

Despite paying 50% for the start-up costs the owner of the investing company only owns 25% of the new company, this is due to the work load, ergo the new CEO will be doing all the work and the investor will do very little, or even nothing.

There are two major advantages to this.

1. Maximise dividend yields

If ‘CTLV’ does well enough to participate in POP, (makes over ZAR 3,200,000 in shareholder discretionary profit) the systems will have proved themselves.

And given that the TFBMS, Villas Cloud, M-Systems and the Villa Secrets network will be substantially more developed, it’s not only likely that another company will be equally successful, it’s likely that such a company will be as successful in less time.

So if ‘CTLV’ were to make ZAR 1,600,000 above its POP point in 2020, and invented it into a new company, this new company would likely make its POP point in 2023 and thereafter the second company would reach its POP point and create a third company in 2025.

Note that if Villa Secrets ‘M-Systems’ are recognised as significant, or we find a significant partner for S-World VBN (Virtual Business Network) those dates could change to 2018 and 2020 and 2021.

Should CTLV manage to generate ZAR 3,200,000 in POP investment in 2020, it would create 2 new companies. Each of which, if they reach their respective POP points in 2 or 3 years will return ZAR 800,000 each in dividends to CTLV each year.

The more companies that are created by ‘CTLV’ via this process, the more such dividends become available.

And in addition the new companies, will in time themselves be creating new companies which will be 12.5% owned by ‘CTLV’

Depending on how much profit one can make above ones POP point, one can end up after 16 years receiving dividends from over 1000 different companies.

Important to note is that if one instead reinvested the same amount of money into ‘CTLV’ in Cape Town, due to the law of diminishing returns and specifically available market share the ROI (return on Interment) would be far less.

2. International Safety Net.

The second advantage of POP investment is that is creates an international safety net. If a Tsunami or worse were too effect Cape Town in the future, one will have many other locations to relocate to

Note that when a company reaches its POP point, from that point onwards the 25% of gross profit contribution that had been applied to operations and boosting, is instead used for investment into philanthropic and ecological projects.

This has been my motivation since March 2011, it just took quite to work out the detail.

In terms of my personal financial remuneration, I can draw a salary from the Villa Secrets operations budget but no more than 25% of the 25% operations, development and marketing contribution.

However, I hope I will not need such funding as I will try and take small percentages here and there from individual companies, and I have high hopes for S-World VSN, VBN & UCS, which I will for now be taking a 25% stake in.

Leave a Reply

Want to join the discussion?Feel free to contribute!