Diary Entries; ‘Lx.’ RES and Reaching Potential

American Butterfly – book 4

The Butterfly

By Nick Ray Ball January to April 2013

Chapter 2.

Diary Entries; ‘Lx.’ RES and Reaching Potential

Index.

Part 1. Dear Diary (take me there)

Part 2. ‘Lx.’ The RES equation & Initial Inventors (take me there)

Part 3. Chelsea FC, Reaching Potential, and a form of QuESC (take me there)

Part 4. ‘Lx.’ part 2, an early version of 11 financial dimensions.

Part 1. Dear Diary – 17th Jan 2013

Having completed the draught of American Butterfly part 4, it was time to tidy up “The Network on a String” and the rest of American Butterfly for evaluation. During this tidy up a glitch in the RES Equation was solved. And when adapted to the Facebook concept “Lx.” it inspired a continuation from the end of the Pressure or Participation “Opportunities,” in the form of a continuation of domino 25: “Chelsea.”

To write the considerations out in full and research it fully would take quite some time. So for now, the raw journal extracts are presented. Which may appear a little over excitable and optimistic at times. Diary “notes” also have the possibility of mathematical mistakes and will generally contain a fair amount of grammatical error.

However, it is in keeping with the history of American Butterfly that at the end of the day, most diary notes eventually end up as credible contingents within the network plans. With this in mind and considering these notes describe important innovations to the business, ecological, and philanthropic ideals of the project; it has been included.

Part 2. “Lx.” The RES equation & Initial Inventors

By Nick Ray Ball, Thursday, January 17th 2013, 10:40 pm GMT

It’s been my first diary entry for quite some time.

I’ve cracked it. I ran into my bedroom grabbed the cover of Steve’s Job’s autobiography and gave young Steve a kiss. Then decided older Steve will oversee proceedings.

But first to set the stage, it’s the day I finished “The Network on a String.” It all boiled down to one area of uncertainty, which was the Initial Input Revenue for the second RES equation example.

To cut a long story short, if we move $1 trillion in wealth from the superrich, money that otherwise would not have been spent, our economy right now would increase its GDP by about… err “the pressure of a quote” I’ll go with $4 trillion. If we call current GDP $70 trillion and add $4 trillion we increase by just fewer than 6%, I’m not going to look it up. But from memory and factoring inflation, I’ve never seen such a rise. There probably has been but the point is it’s a load better than what we got now.

For a start, in general in today’s climate the rich are not spending as it’s perceived as being indulgent. Well ok, but if they spend again, then so can everyone else. So when you see a rich person being extravagant, it’s really best to say, “thanks mate, I really appreciate it” (Think about it).

Where this comes back to Chelsea is with “Lx.” Currently in the Facebook business development camp, Chelsea will pair with Facebook with this initiative. Its ingenious, the very word Chelsea is synonymous not just with “Rich” but “Rich and Cool” and as we know everyone loves Facebook.

This time however we start with Mark and Roman, in an attempt to get the world’s billionaires spending their money alongside the other “Lx.” influencers: Barack Obama, Bill Gates, Hani Farsi, Sheikh Mansour and the many others who are brought into American Butterfly via the Butterfly.

If you have the elite of the elite founding a club it will do well Facebook/Chelsea, Chelsea Lx. – Lx. Galaxy, it may have many names and many divisions, but always “Lx.”

I now see “Lx.” as a very simple but complex network seated at the heart of American Butterfly and indeed the network. Increasing desire to join not to be flash, but to be in with the in crowd.

If we add this to what we already have within the Facebook business development plan which sees margins cut from 100% to 2.5% for Diamond members, along with the freedom to be extravagant and the clique, we have a workable product. That will be loved by all, as we can now show that the superrich spending on its own, will save the day. This initiative is independent of the network. If we launch “Lx.” and receive a trillion in revenue, history will record the following year as an economic golden year (depending on spin within current economics).

If we examine the Facebook business development plan, we see $5 trillion created in additional revenue. This was a plan that most people who will read American Butterfly will have already deemed probable. So in the here and now, to immediately jumpstart our current economy we need only to achieve one-fifth of what seemed reasonable within the Facebook business development plan. It’s all looking very possible.

I’m not sure exactly how much this will make for Chelsea, but seeing as Chelsea would take 50% of the profit and before considering affiliates, that idea of making Chelsea a load of money is looking at lot more structured.

Before continuing with “Lx.”, some thoughts on Chelsea’s core business and a cool marketing strategy which involves closer connection with the fans and would be fans in terms of transfers and formations.

Part 3. Chelsea FC, Reaching Potential, and a form of QuESC

What right do I have to interfere with the Chelsea team and management? It all depends on how good my plan is.

First to management:

Having won the European Cup as underdogs, the only way to beat it is to win as favourites. There is no way this can happen without being favourites to win the premier league. As such that needs to be the focus, an advantage being with the extra curriculum Chelsea “Lx.” activities. Chelsea is no longer concerned with the money made from the European Cup. The only problem, players wishing to play in the cup. And after seeing the road map, if a player feels like that, then they are not the right player anyway. Not that one wants out of the cup, just it’s not a financial problem.

With the primary target set at being favourites for the premiership, I suggest Harry Redknapp alongside keeping Frank Lampard for a few more years. I’m not choosing Harry just because he’s English, but because he’s Harry and he’s English. Having zero academic knowledge of physics or economics and yet doing well, makes me see some affinity.

American Butterfly would never have been written if not for the month each year I dedicate to various Football management games. This habit has upset many girlfriends.

Does playing Football management Sims give you the first idea about really managing a side? Probably in terms of formation and players, yes. In Football manager 2013 I easily took Chelsea to the top in year two by playing without a striker. Hazard and Mata crossing between centre and left attacking midfield, with Oskar on the right, alongside the usual back four. However, I needed to bring in an anchor man and another playmaker. Demba Ba can learn to sit back a little and rotate between the three attacking midfield, who generally always run all over the place whilst the backline and midfield stay static.

As for Torres, the fans are down on him, and he is not enjoying his football. And for everyone that sees this formation idea, there will be a hardened fan saying, “I know just as much about this as he does,” and they would be right. And so no matter what I say the fans are not going to change their opinion. It may cost $10M for the move, but it’s necessary. It would be good to put a buy back clause in though.

Now here is the clever bit. This is just my idea, and I’m nowhere near as certain of it as my ability to bring in the money. I do however think it’s a good idea.

So we ask the fans to set up a Facebook website, the fans submit formations and player transfer suggestions. We throw it all into the mix and settle on maybe four formations. From there, everyone votes and we narrow it down to two. Then everyone votes of the players that should fill the missing roles. For me, within the Football Manager Simulation I picked Lars Bender as Anchorman, Marouane Fellaini as Anchor or ball winning midfield Phil Jones as Central Defence. Theo Walcott as cover for the right plus a more attacking option and Wellington Nem as an all areas attacking midfielder.

These choices were in many ways dictated by price but perfectly adequate within the formation.

So, now all the other Chelsea fans vote for what players we want. On the one hand, a player voted very highly would push up the asking price. But on the other, a player that knows the fans are behind him even before he has kicked a ball may lower the salary. Not that that’s a particularly troublesome point. If we remember Chelsea is co partners with Facebook in “Lx.” And so we will be very proud to pay the best salaries to the players.

However, this PR show of extravagance aside, I would like to return to the original “21st Century Football Theory.” And suggest that after the first season Chelsea adopted a policy of never buying a player. They can come for free or not at all, it’s not a money thing it’s a principle.

The bottom line is the premiership has set rules about profitability and costs. With Chelsea making untold wealth for “Lx.” Playing by their own rules, Chelsea can afford a wage budget 5 or ten times that of their competitors. So as soon as anyone Chelsea wants is out of contract, they will come and at the same time they will be helping save the planet.

Here is where it gets really interesting. The Chelsea fans do not dictate the formation or signings, but they sure do have a big influence. And so the Chelsea fans become part of the decision making process, so there will soon be an awful lot more Chelsea fans…a lot more. It’s the best marketing exercise possible for a football club that wants to diversify.

Part 4. “Lx.” part 2, an early version of 11 financial dimensions.

By Nick Ray Ball Saturday, January 19th 2013 6:46 PM GMT

Just before beginning American Butterfly, back in Cape Town a small business version of POP was considered, basically starting with a block of shares and sub dividing down.

So we now look to spread the ownership of “Lx.” In a similar pattern, first, one needed a block of members that can collectively afford the investment. And then spread it out offering options to all that would qualify.

At the top we see Facebook and Chelsea, (not necessarily the football club, an affiliate) with me as 50/50% partner with Roman. With Mark needing to nominate a partner, preferably Barack Obama or Nelson Mandela. Each person effectively having 25% ownership, from here it splits as half the shares are divided between eighth new partners. This goes on and on until we have in the region of 70 million different individual partners, one place for every 100 persons. Next we considered “Lx.” in terms of presence within each resort network. We already have a subsidised lounge bar, but now we are going big: Private Golf Course, Hotel, and a separate exclusive estate which borders onto Little Hollywood (The live in permanent film location within each resort).

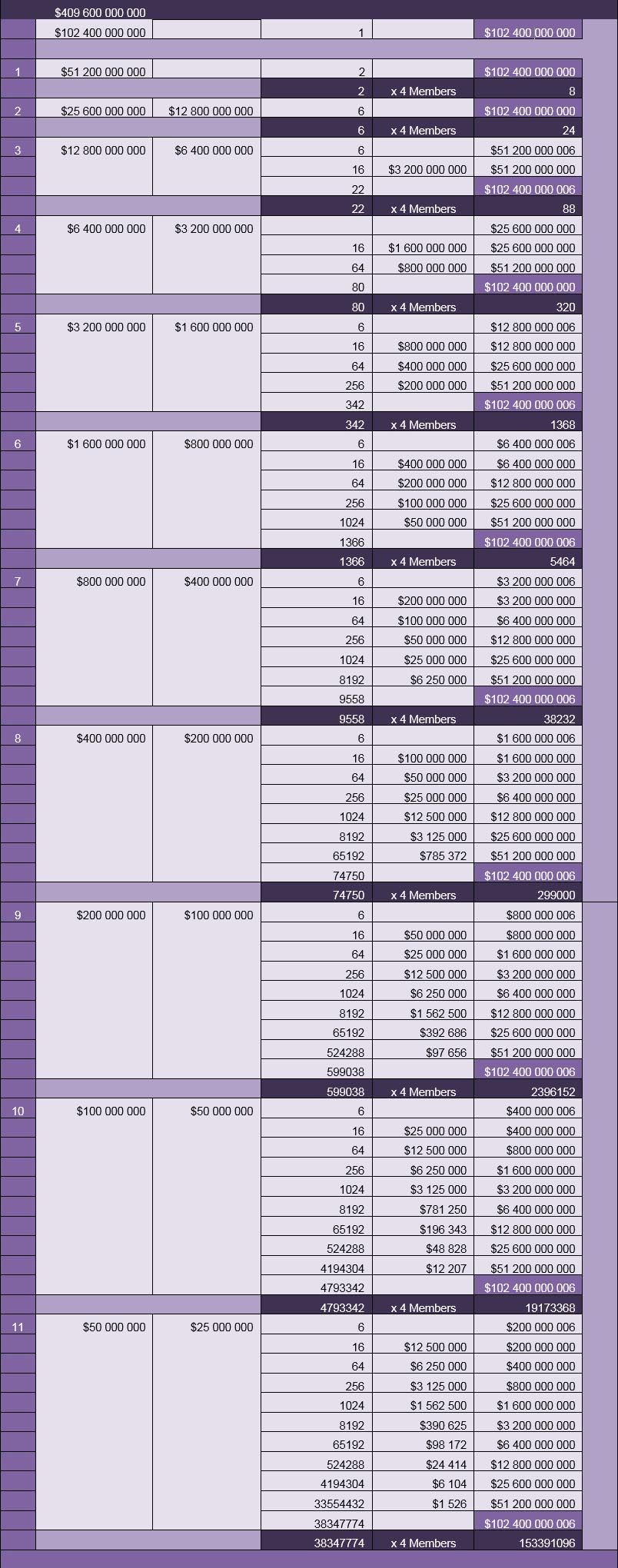

We add up the build costs, or better still assign a percentage of mother networks RNL’s (Resort Network licensees). 10% sounds reasonable so $200 million, multiply by either 512 for all US mother networks or 2,048 for all Global Networks. For now, we will work on the global target. So 2,048 x $200 million = $ 409.6 billion. We divide this by the membership allocation of 70 million persons (who would all need to qualify for “Lx.” membership as per the Facebook business development plan, leaving $5851 per membership).

Note: we may have to adjust the figures later into CFM. Hmmm, on second thought I’ll do it now. So we need to divide the 2 billion in RNL’s by eight, so $250 million. And for the people we will go for 62.5 million members (4 billion ÷ 8 ÷ 8) (Note that 4 billion is the starting number, US mother networks and indeed all networks are actually half networks, to be twinned at a later point).

Note: I need to factor in the share splits so each level of entry always has more shares than the level below, as used on www.s-world.biz “Sparta Rises Again” Chapter 23: The Micro Business Plan.

Two hours and an impressive spreadsheet later, we have 153,391,068 members with eleven tiers. At the top eight equal shareholders with $50 million in RCL’s, where after allocations decrease until the eleventh tier where RCL allocation is $1,562 for 134,217,729 people. This would be basic “Lx.” Membership.

Saturday January 19th 2013 11:31 PM GMT

“Lx.” is developing nicely, but first we need the spreadsheet. It’s an older piece of CFM, but in context of “Lx.” it works fine. This piece of CFM was originally created to split the ownership of a company’s shares between many people whilst still leaving definitive hierarchal structures.

What we end up with is a two-tier structure, from the top down and the bottom up. Starting at the bottom if one is qualified to join “Lx.”, which considering privacy issues, means the top 2.5% of net earners or net wealth holders (We target top 1% of net earners and wealth holders, but will not be overly pursuant for proof so creative accountants could push top 2.5% in).

Starting at the bottom, level eleven memberships can be purchased for $1,526. Importantly, the first to apply for membership are the first to receive options to upgrade to 10th tier membership which costs $6,104. Where after then same first members to apply will receive the first option to rise to 9th tier membership at $24,414 and so on, and so on.

Whilst on the basics, the tiers of membership will be dependent on one’s net earnings or wealth. As such a billionaire would be able to get into the 5th tier of membership for $3,125,000 and be one of 1,368 5th tier and above members.

Note: From this point onwards, moving up or down in membership becomes reliant on how much the members spends via “Lx.”, their EEE points and/or their contributions in general to the network.

When it comes to the superrich, with mark Zuckerberg and Roman Abramovitz only owning $50 million, it’s not about the money. If we further consider the 11th tier, the top 2.5% of the world earners and wealth holders are not particularly concerned about an investment that costs $1,526 even if it makes a hundred fold in returns.

What “Lx.” gives to its members is piece of mind. Currently the RES equation suggests spending from the superrich will multiply by four as a contributor for GDP and we are looking for a trillion spent. But with our current system we cannot be sure of the multiplier effect, but we can if the money is spent with “Lx.”

The kick ass thing about the RES equation is that it shows the general public, the people like me, that if the superrich are extravagant, all will benefit. So on one side we have the general public loving the superrich for being extravagant, as will be available to see via S-World UCS (only if the “Lx.” member is comfortable).

This consideration is gigantic. But more gigantic still are the consequences to the superrich themselves, of whom many or even most live within an eternal guilt trip concerning the rest of us. Now with “Lx.” they can spend, spend, spend with the net result being that they have really helped a lot of people. We may see billionaires spending large amounts of their fortune on themselves and their friends.

Of course the higher one’s tier in “Lx.”, the more you get to talk to the people at the top of American Butterfly.

Due to working the scenario out in “CFM,” the top tier is eight people. I’m not saying it will be these people, but the following look good: Myself, Roman Abramovitz, Mark Zuckerberg, President Obama, Hani Farsi, Bill Gates, Al Gore and Nelson Mandela.

Each member within the first tier of “Lx.” can purchase $50 million in “Lx.” RNL’s (Resort Network Licences). The second tier sees 16 members at $25 million each. These membership options will be split two per 1st tier member. From which point the third tier sees 64 new members, half nominated by tier one members and half by tier two. This system repeats until the lower tiers are full from direct membership applications.

Bearing in mind that the investment value will never excite any members, we start to see membership rankings from the 11th to 1st tier as a sign of prestige.

This said, membership is profitable.

Unlike traditional RNL investments, “Lx.” investments which will span 12.5% of all mother networks will not see a pro rata share of the real estate and commercial buildings, there are too many sub divisions. Instead members will see a pro rata share of profits, paid off course in network credits. As far as member clubs go, with the power of the SUSY 16 it’s heaven sent.

Tuesday, January 29th 2013: 05:38 PM GMT

The following is a transcript of sorts of various entries made within my notebooks since the above diary entry.

Firstly, to profit centres for “Lx.” it’s very early days. However, it seems best to split the “Lx.” profits 50/50 between members as per above and a set of reseller companies: Facebook, Chelsea maybe Apple and others.

If we look at the profit centre within the Facebook business development plan in “The Theory of Every Business” we saw about $170 million per network in reseller (Facebook) profits. Split over more companies who already in one way or another have exclusive clientele, this figure could well be met and exceeded.

To add a little more certainty we need to consider the nature of Network Credits and who will be receiving lots of them…“Lx.” members, in one way or another will receive a lot of credits. And I suggest in most cases considering the service and low mark ups, most credits will be spent with “Lx.” And whilst they are not cold hard cash, for accounting purposes they are exactly the same.

The greater the success of the network in general the more credits will go to and be spent by “Lx.” members, be it on travel, property, super yachts or weekly shopping. In the same way the over time POP pushes the network into greater order. Network credits effectively increase the spending by “Lx.” members to “Lx.” resellers.

The more the resellers make, the more credits the members get and so and so on.

Another profit centre comes from the development itself, as it can now be unashamedly extravagant. In a moment we shall hear about the Experience Africa plan. Which will be mimicked by “Lx.” thus creating a very desirable resort. However, within “Lx.” for the first time we can consider property sales as a revenue source.

There will be enough land to build a thousand houses. Maybe more, if marked up at double the build cost, just because we can. We can expect between $2 and $10 million profit per house. Average it at $4 million x 1000 = $4 billion ÷ by 32 years equals an additional $125 million a year, plus extra due to property reselling.

I would expect there is also money to be made from financial services.

All told by the time others have added to this, we are looking at well over the 2018 98% profit vs. investment attained by the Suppliers Butterfly for construction companies. Plus of course, there are many suppliers to be considered as well. And as we have seen, that is where the real money gets generated by “Lx.” in terms of network profitability and GDP.

Lastly, (for now) come the many new business “Lx,” will create via POP, all adding to the communal members and resellers annual return on investment.

Leave a Reply

Want to join the discussion?Feel free to contribute!