The flap of A Butterfly’s Wings

Angel Theory – Paradigm Shift: Book 2.

Backstory / Prequel

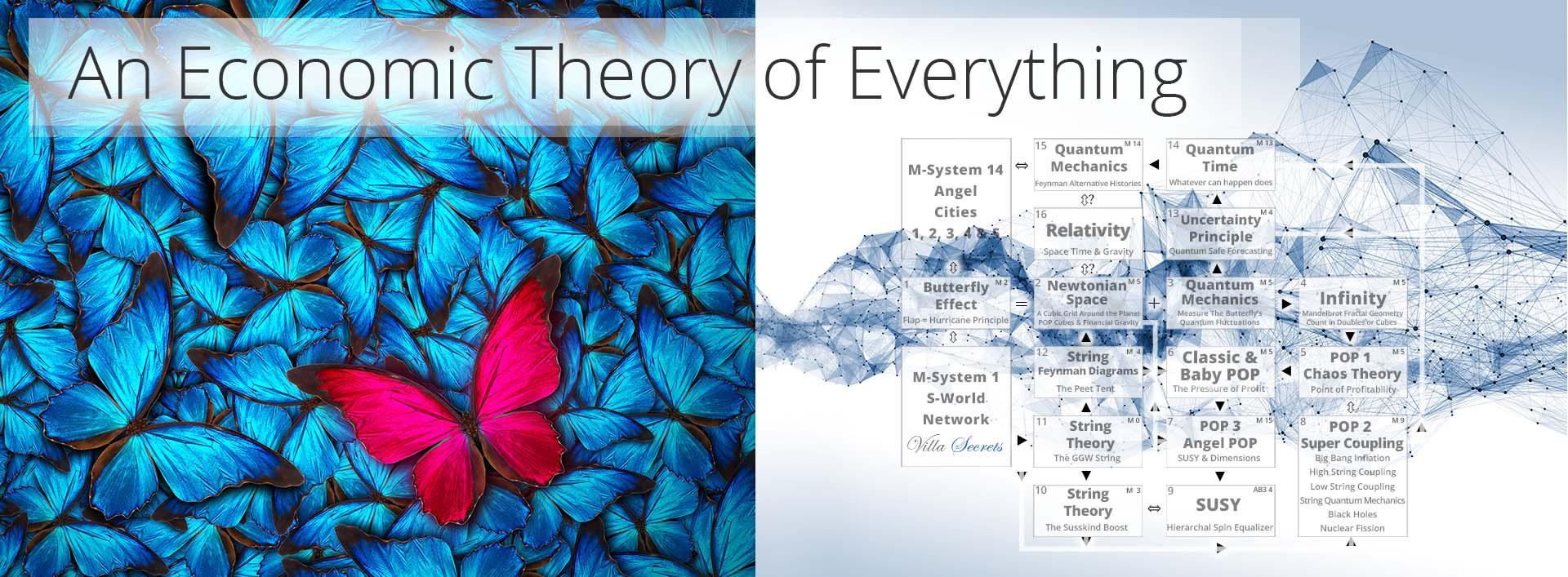

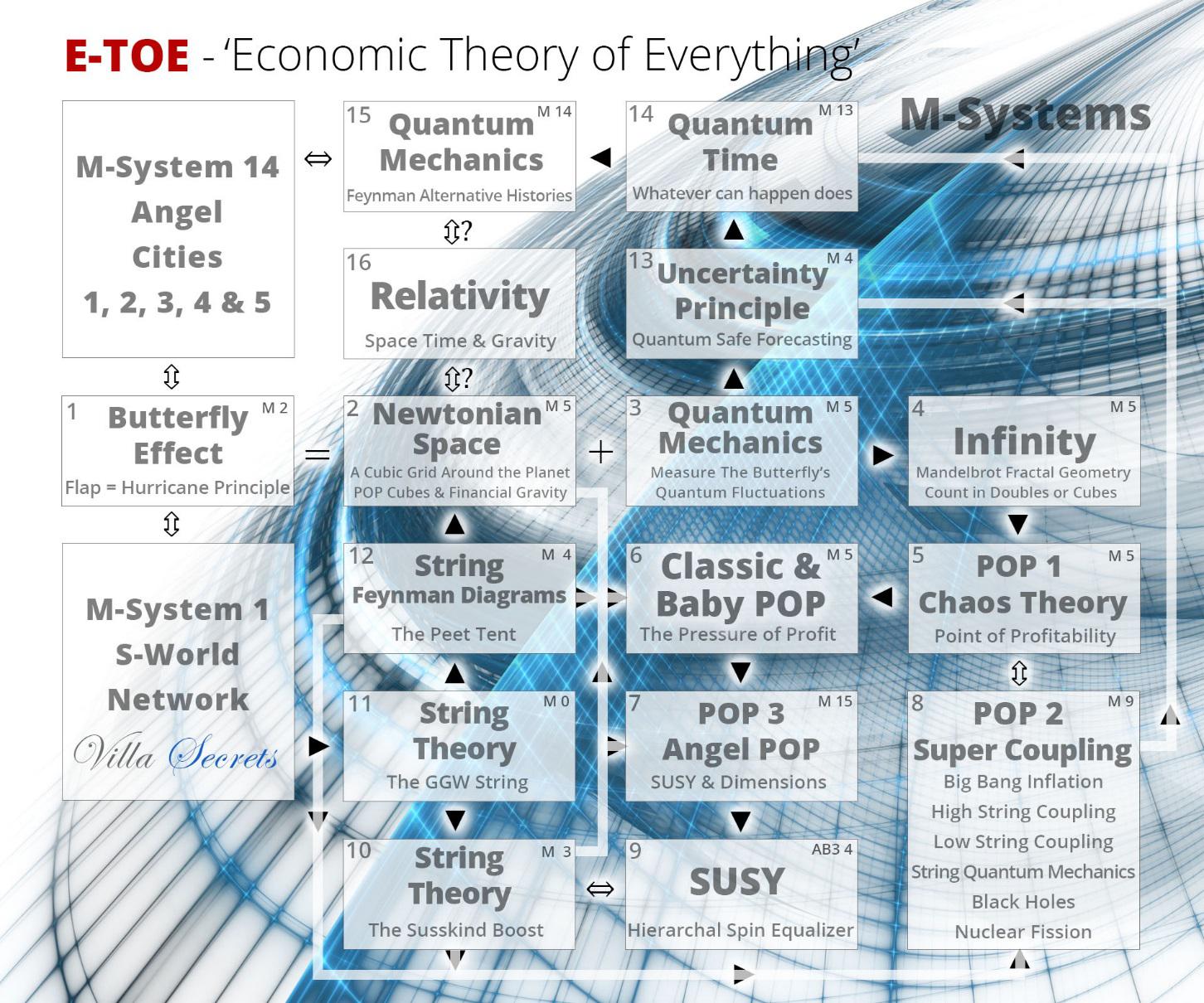

An Economic Theory of Everything

By Nick Ray Ball 13th December 2017

PRESENTING:

Chapter 2: The flap of A Butterfly’s Wings

An Economic Theory of Everything Part 2: From the flap of a butterfly’s wings to the financial gravity of the network.

Inspired by Sienna Skye

In 2,238 Words

Version 6.59-2r2

POP Origins:

The Butterfly Effect and Chaos Theory

Steps 1, 2, 3, 4, 5, 6.

Part 2. Chapter 1b: Butterfly POP Basics

Steps 1-3. POP Origins (The Butterfly Effect)

The Butterfly Effect, Newtonian Space, and Measuring at a Quantum Scale

In and around the Autumn of 2011, starting with limited knowledge of pure math, zero knowledge of theoretical physics (and certainly no idea about Einstein’s theory of special relativity); the initial journey to the discovery of POP (The E-TOE) was a consideration of ‘the butterfly effect’ and the saying:

“Can the flap of a butterfly’s wings in Brazil create a tornado in Texas?”

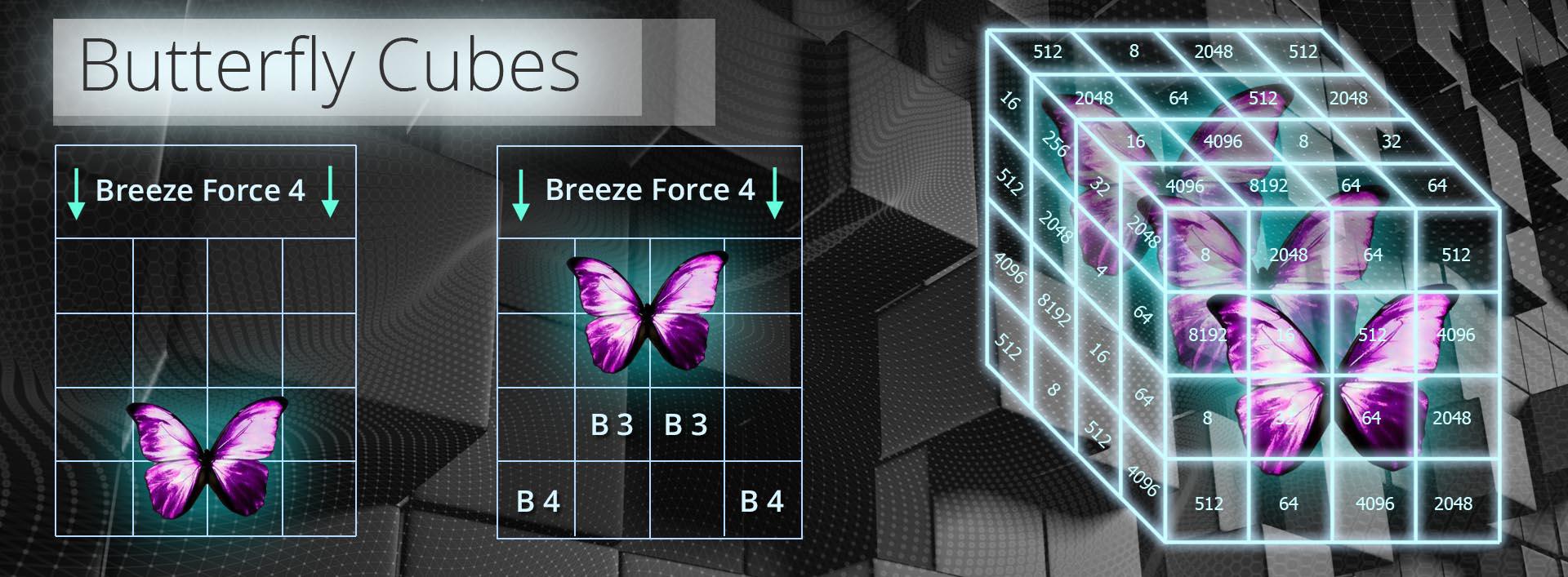

To create a solution, I conducted a thought experiment and pictured an imaginary cubic grid around our earth in every direction.

And inside one cube was our butterfly; where after using a future technology, one could measure the tiny disturbances in the ‘breeze force’ created by the flap of the butterfly’s wings, and then calculate across all cubes to see if that flap did or did not cause the tornado.

About a year later, courtesy of Professor Brian Greene’s’ ‘The Fabric of the Cosmos’ and ‘The Elegant Universe,’ this grid was seen to be common with Sir Isaac Newton’s picture of gravity and Einstein’s theory of special relativity. And the idea of measuring the tiny disturbances was not unlike quantum mechanics, so making this little idea its own ‘theory of everything.’ Just add Einstein’s theory of gravity and all the components are there.

This is important as it helps to explain the methodology of how one goes from a theory in physics to a theory in business and economics. Put simply, whenever a part of the network design is seen to be similar to a system that describes nature, we pay a lot more attention to it, and we look at all sorts of TOE physics to see if we can find inspirations; and over the years, these symmetries and simulations have built up and fit together almost magically.

In Professor Stephen Hawking & Leonard Mlodinow’s book ‘The Grand Design,’ a very simple and solid thread for why following the laws of nature, as described by M-theory, would be an advantage in economics is presented:

“The laws of nature are meant to economically compress a number of particular cases into one simple formula.”

When designing a system for oneself, one has infinite amount of options and each is its own theory, which may or may not work out the way one planned. But by following the laws of nature, one not only has a road map of sorts, one is benefiting from billions of years of fine-tuning. And because of that fine-tuning, the components in the system are economically compressed. So, all parts of the system work well together even if there was no strict plan for such by the designer in the first place.

However, we all have to start somewhere. In terms of the ‘theory of everything’ related systems, the beginning of this journey was the original thought experiment of the butterfly within the cubic grid; and with this consideration on my mind, I looked at the parent discipline of the butterfly effect, ‘chaos theory.’

Chaos Theory (2011)

The next consideration was the chaos theory riddle of rounding errors, created by rounding numbers in general and infinite numbers like 3.33333 recurring.

Because of the butterfly effect, even the smallest of inconsistencies could spiral into a tornado, and was enough to rule out any kind of long-term forecasting in any complex systems, such as the weather or our economy.

The journey to a solution probably began subconsciously via my 12 years working as a W-30, then Cubase music programmer in the late 80s and 90s, all of the time working in subsets of 8 bars.

Music and Chaos Theory

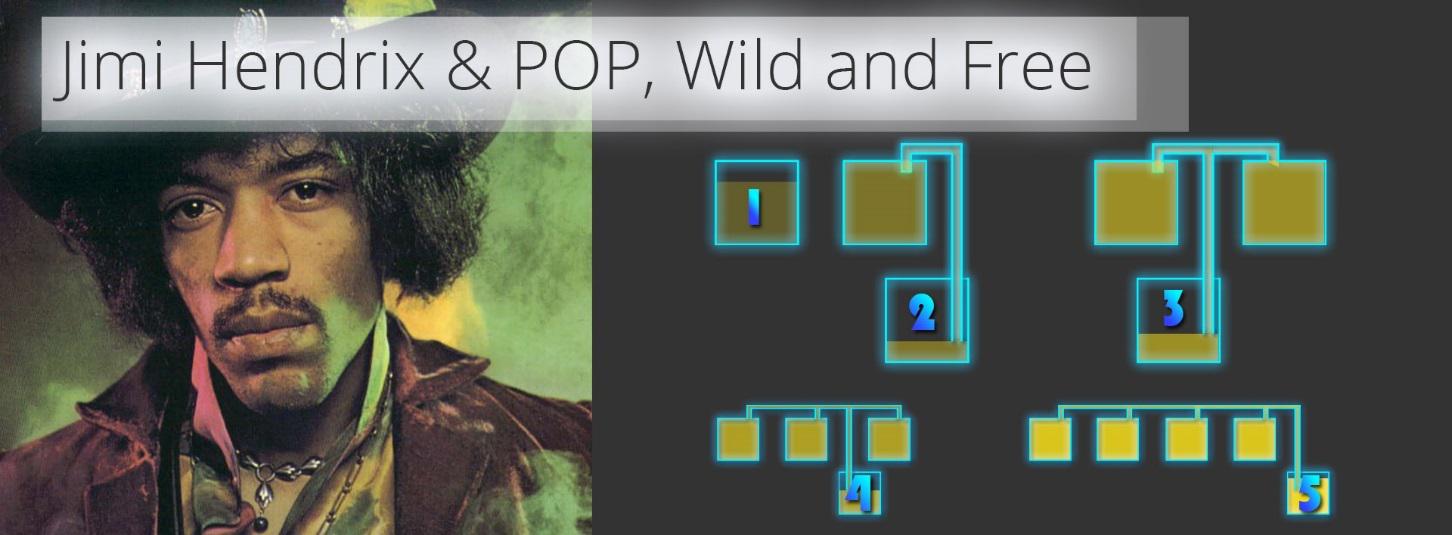

If we consider Jimi Hendrix, we would not necessarily apply the phrase: “An Island of Order in a Sea of Chaos.” Indeed, we would not use the word “order” at all.

Imagine Jimi Hendrix playing wild and free, live, freestyle, jamming with the band as opposed to following a particular song structure. But, despite the chaos, the song has order as applied by the percussion, and the compartmentalizing of time by beats which keeps everything together.

We don’t think ‘order’ when we think about ‘The Who’s’ wild drummer Keith Moon, who would (from time to time) lend my Dad his Bentley and chauffeur to take out dates. But as chaotic as his beats were, they were always in time, within various grove quantizes of a standard 8 bar sequence of music.

Unless of course he was kicking the drums over, then its chaotic.

But all the time the music plays, it plays in time. The beats are the order within the chaos of a song.

The POP investment principle follows this pattern, where companies or networks of companies trade wild and free, making as much as they like; but at a certain point of profitability, a line is drawn from which point onwards, the additional profit is invested into a new network, and the proverbial next musical bar begins.

Crazy Equations

Before coming to a conclusion that made sense came a wild ride of a day spent mostly in the 300 Dolphin Bay mountains (Hout Bay, Cape Town) considering a crazy equation that started with the rather ambitious title ‘Proving God,’ which by the end of the 14-hour session accepted that this could not be proven by me at this time. However, in its place, came the idea that there is a universal truth within the idea of positivity. And that the more positivity you apply to a system, the more powerful it will become, which lead to a system made out of many theories and truck loads of ripple effects.

Step 4. The Mandelbrot Set (Oct 2011)

This crazy equation helped point me in the right direction. And after some research, including the Mandelbrot Set Fractal (that beautifully recreates itself in an infinite pattern), I had a very basic idea for ‘compatible finite mathematics’ which did not try to beat infinity per se, just get close enough to negate its chaotic idiosyncrasies, maybe like renormalization in QCD.

For the original inspiration, see www.S-World.biz/TST/EEE-14Billion_Years.htm (Nov 2011).

The first simple solution was to count and create a framework with numbers that doubled, as that makes recurring numbers harder to create. So, 2 > 4 > 8 > 16 > 32 etc.

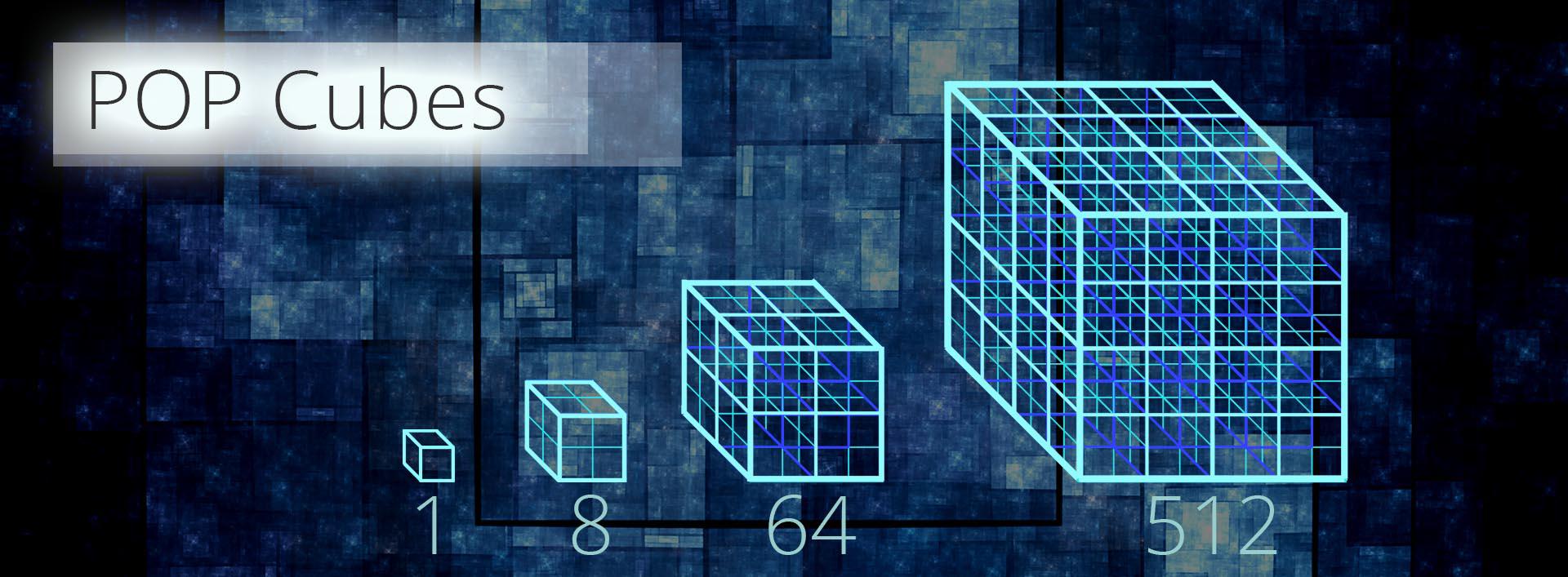

However, considering the cubed grid around the world, this soon turned into multiplying by 8. So, 1 > 8 > 64 > 512 > 4,096 > 32,768 as multiplying by 8 creates cubes inside of cubes.

Step 5 – (M-System 5) The POP; Point of Profitability – POP Cubes (2011)

The rounding errors solution was to create a point of profitability; where after all profit overflows into creating a new company or network, then by working in multiples of 8, we create predictable cubes of underlying profit that have no errors to round. For example, a POP point may be $1,342,177.28 (which is $0.01 x 8, nine times). If this is a company or network of companies’ POP point; once reached, all additional profit pours into creating new companies, networks, or special projects, or often both as macro networks are special projects.

In this case, it did not matter how chaotic the inner workings are, as this company (or set of companies) would be recorded simply as 1. And after, other companies with the same POP point would fit together to make a set of 8 and $10,737,418.24 ($0.01 x 8, ten times), and we count the economy simply as stable financial POP blocks, within a base 8 cubic structure which has no rounding errors to round.

It’s not perfect as its only telling us the underlying profitability. But it does create a strong financial gravity to the network; with the only concerns being getting companies to their POP points in the first place, then making them double their profit as that is the POP investment, and most complexly making sure they don’t fall back, which is the task of the string theory systems: ‘The Susskind Boost’ and ‘The Peet Tent,’ told soon within this chapter.

By working in this way, we create an underlying stable economic framework that is not affected by rounding errors as there are no recurring numbers to round. One simply counts the full POP cubes. Once a cube is full and each company within has achieved its POP point, the cube would represent a single block of underlying profitability, and could be counted simply as 1. And other cubes created counted as 2, 3, 4, 5, 6, 7, 8 at which point we created a larger dimensional cube, representing 8 networks of companies making their POP points. This follows to the next dimension of 64, and then next at 512 companies, all making their POP points and continues to increase in multiples of 8.

Which as Sir Isaac Newton’s theory of gravity is often presented as the universe within a cubed framework eventually took on the name ‘financial gravity.’

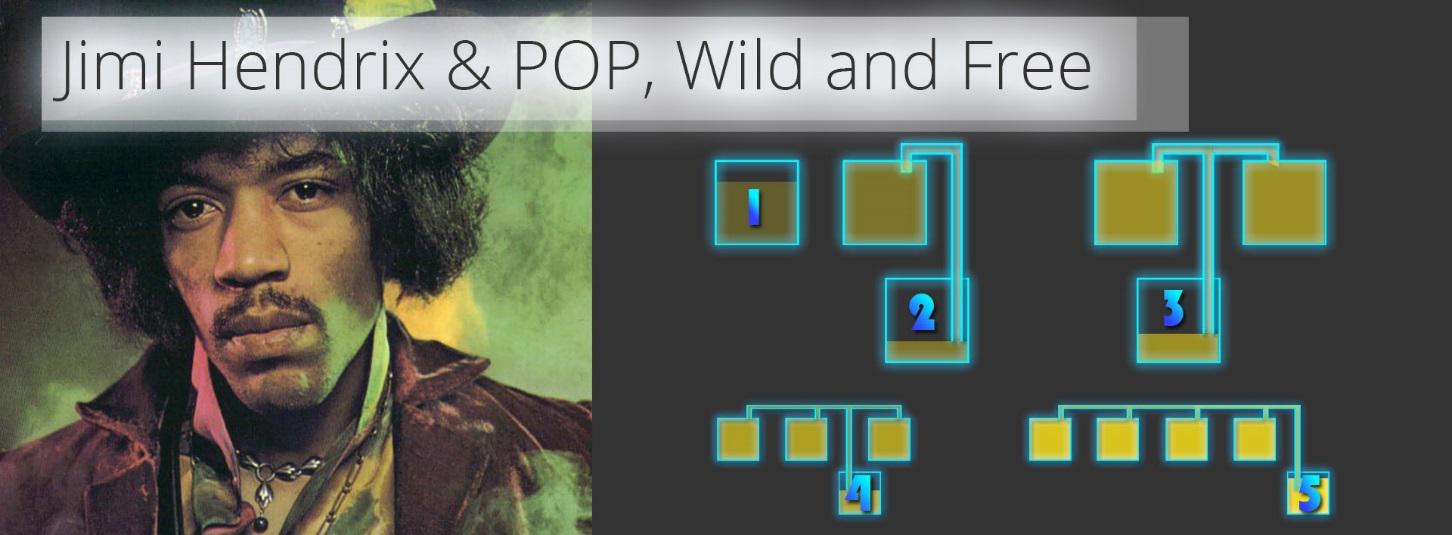

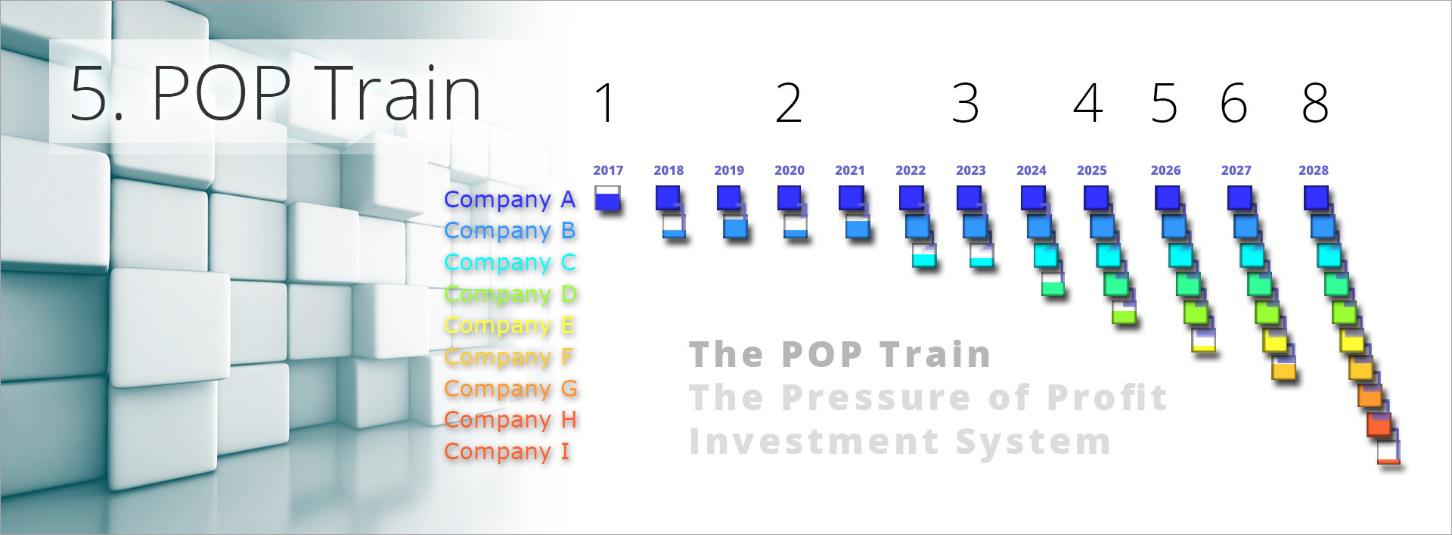

Step 6 (M-System 5) – The POP Investment Principle – The POP Train (2011)

What turned a mathematical curiosity into the mathematics that underpinned the entire project was revealed when making the graphic you see above called the POP Train.

This point may have been subconsciously influenced by the South African Bulls rugby team and their train tactic; where three, then four, then five players line up behind the ball carrier and push in series, and the pressure of 5 teammates pushing in a line breaks through the opposing team’s defence.

When investing in a POP train, all the POP investment from the first network of companies flows into the second (and we call the object that the overflow falls into a ‘bucket’). Once bucket 2 is full, both networks 1 and 2 combine to fill ‘bucket 3.’ And once bucket 3 is full, networks 1, 2, & 3 combine to fill ‘bucket 4.’ After which new networks are created annually and the network snowballs and grows exponentially.

We can see this process on the right of the Jimi Hendrix graphic below; the brighter the gold, the faster the POP Train.

Hence POP ‘The Pressure of Profit,’ as the more companies in the train, the greater the pressure and the faster new networks are created.

“It’s a bit like pushing a bus over a cliff edge – it takes some effort to get it started but when it goes, there is no stopping it.”

Quote by Brian Cox and Jeff Forshaw

It’s important to note that for small S-World companies, POP is an investment not a tax, albeit a long-term investment that the invertor has no control over.

The plan is to make the investor a better than average return over 8, 16, or even 32 years. However, along the way, we may use the money to create Grand Networks, or to sponsor other philanthropic or ecological projects; or in the case of Grand Networks in locations of abject poverty as Grand Networks in locations of abject poverty are both philanthropic & ecological projects.

One simple example would be that via its POP contributions, a company could afford a Villa in one of the Grand Network developments, and for 16 years it was rented, but the money from the rentals went back into the Grand Networks expansion and expenses. However, at the end of the 16 years, the Villa is returned to the company and can be sold; and if all has gone to plan would have increased by much more than inflation.

There are absolutely no promises on POP investment, it may be best considered as a ‘Give Half Back’ charity donation that applies when companies do well, that may or may not pay dividends later down the road.

Of course, in a system of thousands of cubes, each containing thousands of individuals and companies, where we count the cubes in sets of 64; often there may be a few inner dimensional cubes that have fallen out of POP (had made it to their POP point but since slid backwards). So, we must count 61 of 64, 57 of 64, 63 of 64 and so on.

This can create rounding errors and that’s why in 2012 we called it, ‘compatible finite math,’ as the math is not perfect, just better. However, when we added string theory to maintain and repair the POP cubes that had fallen backwards, we can bring all networks back to 64/64.

String theory is important to the economics as it maintains the integrity of our cubic economy, and is necessary in theoretical physics to do much the same; but for the fabric of our universe at extreme points such as black holes and the big bang where there is a lot of heavy stuff, but it’s all very small.

To help fill in the gaps and fuel networks that have fallen behind, we need to move into string theory and skip forward to Step 10: M-System 3. The Susskind Boost.